Market Trends of Barrier Film Packaging Industry

This section covers the major market trends shaping the Barrier Film Packaging Market according to our research experts:

Food Industry to Augment the Market Growth

- Protection, preservation, maintaining, and extending the shelf-life of food products are the primary challenges faced in the food industry.

- Food products are affected due to both intrinsic parameters, such as pH, preservatives, and water activity, as well as extrinsic parameters, like temperature, humidity, and gaseous environment. Barrier film packaging solution allows mitigating these challenges.

- Barrier film is extensively used for products, like bakery goods, biscuits, frozen foods, pet food, chips and snacks, meat and dairy products, and dry fruits in the food industry.

- Moreover, companies are manufacturing barrier film packaging solutions that provide high emphasis on developing 100% recyclable products to promote a circular economy in the packaging industry. For instance, Innovia Films recently launched its new series of transparent barrier film packaging solutions for cereal bars, biscuits, snacks, dried fruits, nuts, tea, and coffee. These products are designed with standalone mono film or to be used in laminated construction so that they can be recycled readily.

- Consumer, today, are focusing on convenience and purchase grab-and-go products rather than bulk buying; this is resulting in high demand for packaged food. The trend of grab-and-go food and snacks is driving the demand for barrier film packaging solutions in the food industry.

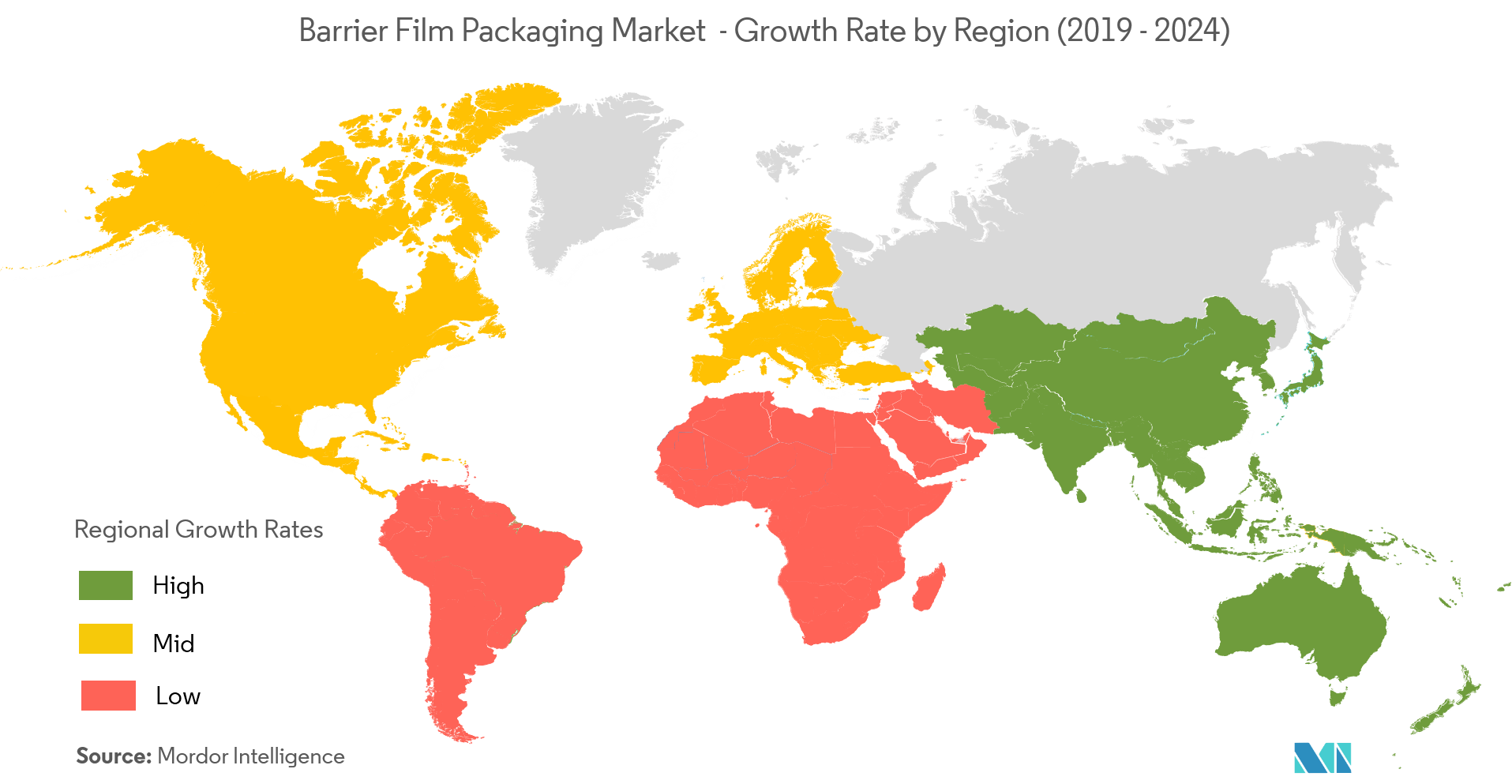

Asia-Pacific to be Fastest Growing Market

- Asia-Pacific is the third-largest pharmaceutical market after North America and Europe. The region has densely populated countries, such as India and China, that have significantly contributed to the production of pharmaceuticals in the region.

- India is the source of 60,000 generic brands across 60 therapeutic categories and manufactures more than 500 different Active Pharmaceutical Ingredients (APIs). The Department of Pharmaceuticals aims to make the country a hub for end-to-end drug discovery under its ‘Pharma Vision 2020’.

- The country is home to 3,000 pharma companies, with a strong network of over 10,500 manufacturing facilities. According to the National Investment Promotion & Facilitation Agency, the domestic pharmaceuticals market turnover reached USD 18.12 billion in 2018, up 9.4% from 2017, growing as penetration of health insurance and pharmacies rise. The increasing pharmaceuticals production in the region is significantly driving the growth of the barrier film market in the region.

- According to the US Agriculture Department, China consumed around 74 million metric tons of pork, beef, and poultry in 2017, approximately twice as much as the United States. With a growing preference for Western-style packaged meats, such as various steak cuts, coupled with increasing meat imports to the country, the market for retort packaging for these meat products is expected to drive the market in the region.

- Moreover, the region is also witnessing an increase in demand for ready-to-eat food. Ready-to-eat meals (REM) or take-home food items represent an important area of growth, and sales from this sector are essential to increase the retail food and beverage industry revenue. According to the Japan Ready-Made Meal Association, total sales in 2017 were JPY 10.155 trillion (USD 89.78 billion), and in 2018, total sales were JPY 10.351 trillion (USD 92.12 billion), which was 1.9% higher than the previous year. Such factors are anticipated to boost the growth of barrier films in the food and beverage industry.