Market Share of Automotive Inertial Systems Industry

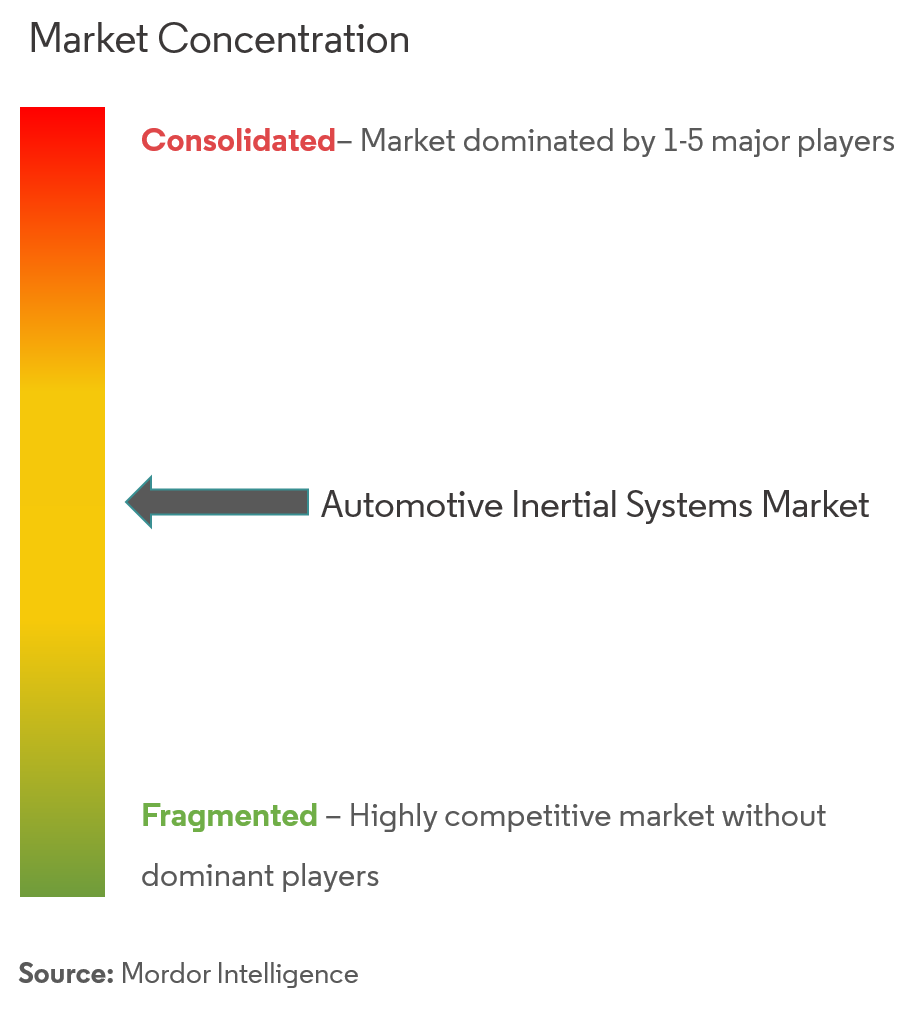

The automotive inertial systems market is moderately competitive and consists of a few major players. In terms of market share, some of theplayers currently dominate the market. However, with the advancement in sensor technology across the inertial systems, new players are increasing their market presence thereby expanding their business footprint across the emerging economies.

- October2019 -Honeywell launched the HGuide i300, which is a high-performance MEMS-based Inertial Measurement Unit (IMU) designed to meet the needs of applications across various markets, including agriculture, AUVs, industrial equipment, robotics, survey/mapping, stabilized platforms, transportation, UAVs, and UGVs. With industry-standard communication interfaces and a wide-input voltage range, the HGuide i300 can be easily integrated into a variety of architectures. The extremely small size, lightweight, and low power make the HGuide i300 ideal for many applications.

- June 2019 -Emcore announced a new addition to the Emcore-Orion series of Micro Inertial Navigation (MINAV) systems. It was launched at the at the Paris Air Show. The EN-2000 is a closed-loop, solid-state design that will deliver higher performance at lower cost than traditional RLG (Ring Laser Gyroscope) navigation systems.

Automotive Inertial Systems Market Leaders

Honeywell International Inc.

Robert Bosch GmbH

MEMSIC Inc.

TE Connectivity Ltd

EMCORE Corporation

*Disclaimer: Major Players sorted in no particular order