Market Trends of Vendor Management Software Industry

This section covers the major market trends shaping the Vendor Management Software Market according to our research experts:

Retail Sector is Expected to Hold the Largest Share

- The retail industry depends on many third-party vendors and suppliers for their inventory. It makes retailers prone to many risks. Therefore it becomes imperative for these retailers to look for solutions that help them mitigate such risks. It is expected to boost the vendor management software market demand over the forecast period.

- Quantivate's supplier and vendor management for retail allow retailers to identify potential supplier risks, verify that suppliers are compliant, and continue to monitor changes that can create new chances.

- The companies in the industry are involved in various strategies to maintain their market position. For instance, in August 2022, Volt Systems, a digital firm that offers suppliers more on-demand access to merchandising resources, was acquired by Walmart.

- The increasing trend in retail sales makes vendors serve their customers better, and maintaining healthy relationships with their suppliers is equally important. Vendor management software allows the vendor to satisfy both parties, fueling the demand for the VMS over the forecast period.

- The fluctuating market conditions and consumer trends are responsible for the varying Product pricing and promotion, which makes it essential for retailers to adjust and adapt to such changes quickly. The VMS helps retailers achieve this need, boosting the market's growth over the forecast period.

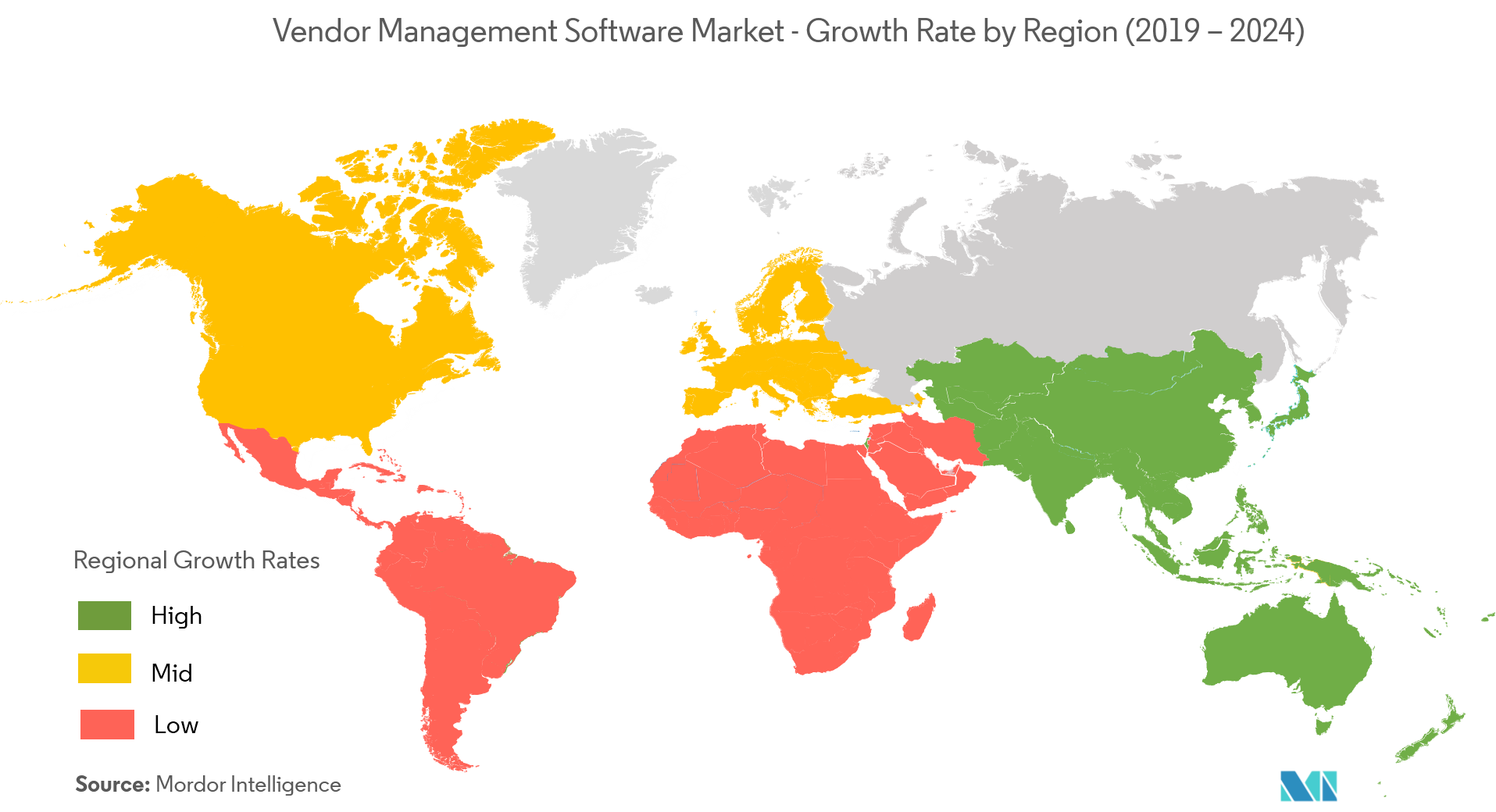

North America is Expected to Hold Significant Market Share

- The region includes a well-established distribution channel for all retail companies, making it imperative for the vendors to effectively and efficiently manage the entire distribution channel. VMS provides a perfect solution to the question.

- The US retail industry is undergoing two significant transitions, one being the technological and the other being the result of the changes in consumer behavior. It is expected to boost the demand for VMS in the region over the forecast period.

- According to The US Census Bureau, total retail sales at the end of 2021 were roughly 6.6 trillion dollars, an increase of around USD 1 billion from the previous year. This increase is expected to fuel the VMS growth in the region throughout the forecast period.

- The government's increased funding of SME development is anticipated to fuel the demand for vendor management software. For instance, in August 2022, the US Department of Treasury approved an additional batch of four state proposals for up to USD 750 million in funding under State Small Business Credit Initiative (SSBCI). Treasury announced financial approvals totaling more than USD 2.25 billion to support small company growth through SSBCI.

- With banking and financial institutions relying on third-party vendors for many of their operations, it becomes essential for these institutions to embrace a robust third-party vendor management program that helps them assess, measure, monitor, and control such risks. Some of the prominent players in the region are providing software solutions that help these institutions mitigate or terminate such threats, thereby boosting the market in the area. For instance, Ncontracts LLC's Nvendor enables financial institutions to achieve and maintain regulatory compliance with third-party vendor regulations and guidance.