Market Trends of Third Party Payment Industry

This section covers the major market trends shaping the Third Party Payment Market according to our research experts:

PoS Segment will Drive the Market

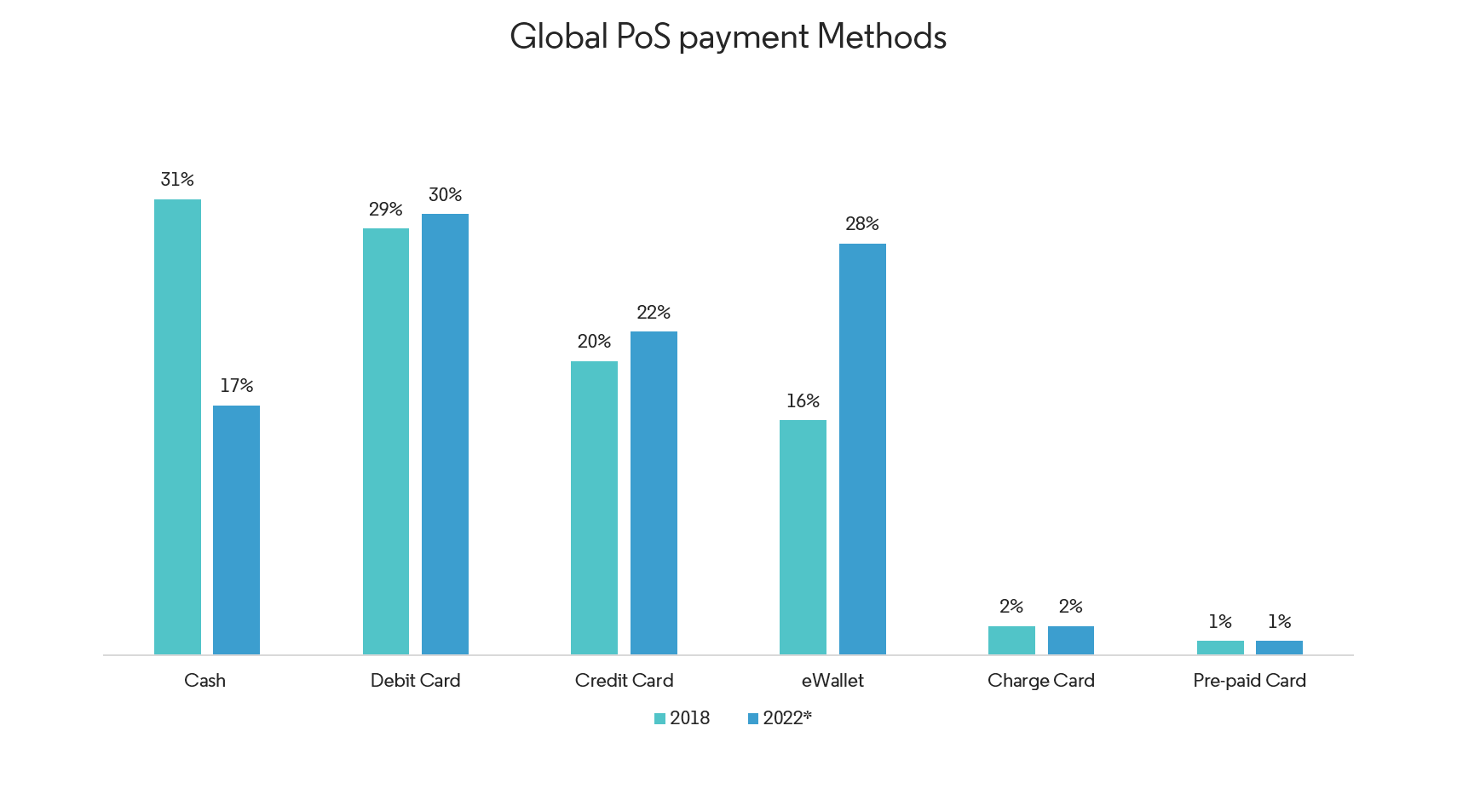

- The PoS segment remains dominated by Cash transactions, and predictions of a Cashless future aren’t expected to be realized any time soon. However, this segment continues to witness radical transformations as there is a dramatic shift from cash to eWallets.

- According to the Global Payments Report published in November 2018 by Worldpay, cash will be superseded by debit cards as the leading PoS method in 2019. It further adds that Cash will fall to fourth place by 2022 behind debit cards, credit cards, and eWallets.

- High growth regions like APAC and EMEA that will drive the growth of Third Party Payment Market in the future are projected to witness a double-digit reduction in the use of Cash at PoS, the report further adds.

- For instance, PoS has a huge opportunity in India. The number of PoS terminals in India stands at 3.4 million in 2018 with the total number of PoS transactions using credit and debit card at 554.45 million. There has been an entry of big players like Reliance which launched its operations in six cities Mumbai, Bangalore, Hyderabad, Chennai, Pune, and Kolkata, on a pilot basis.

- The other factor that will lead to the growth of this segment is the increasing use of mobile point-of-sale (mPoS) devices. According to a recent blog by Mobile Payments Today, industry experts predict that the number of mobile PoS transactions will triple by 2023. Experts further add that larger merchants are driving growth in the mPoS, expected to cross 27 million devices worldwide by 2020.

- Further according to the US Payments Forum’s press release of Dec 2018, counterfeit card fraud in 2018 has come down by 80 percent. This has been possible because 99 percent of the top 200 retailers are now chip-enabled, and chip-on-chip transactions make 60 percent of the total transactions in the U.S., highlighting the fact that the industry is capable enough to fight back against any fraud taking place due to the digital transactions at PoS terminals.

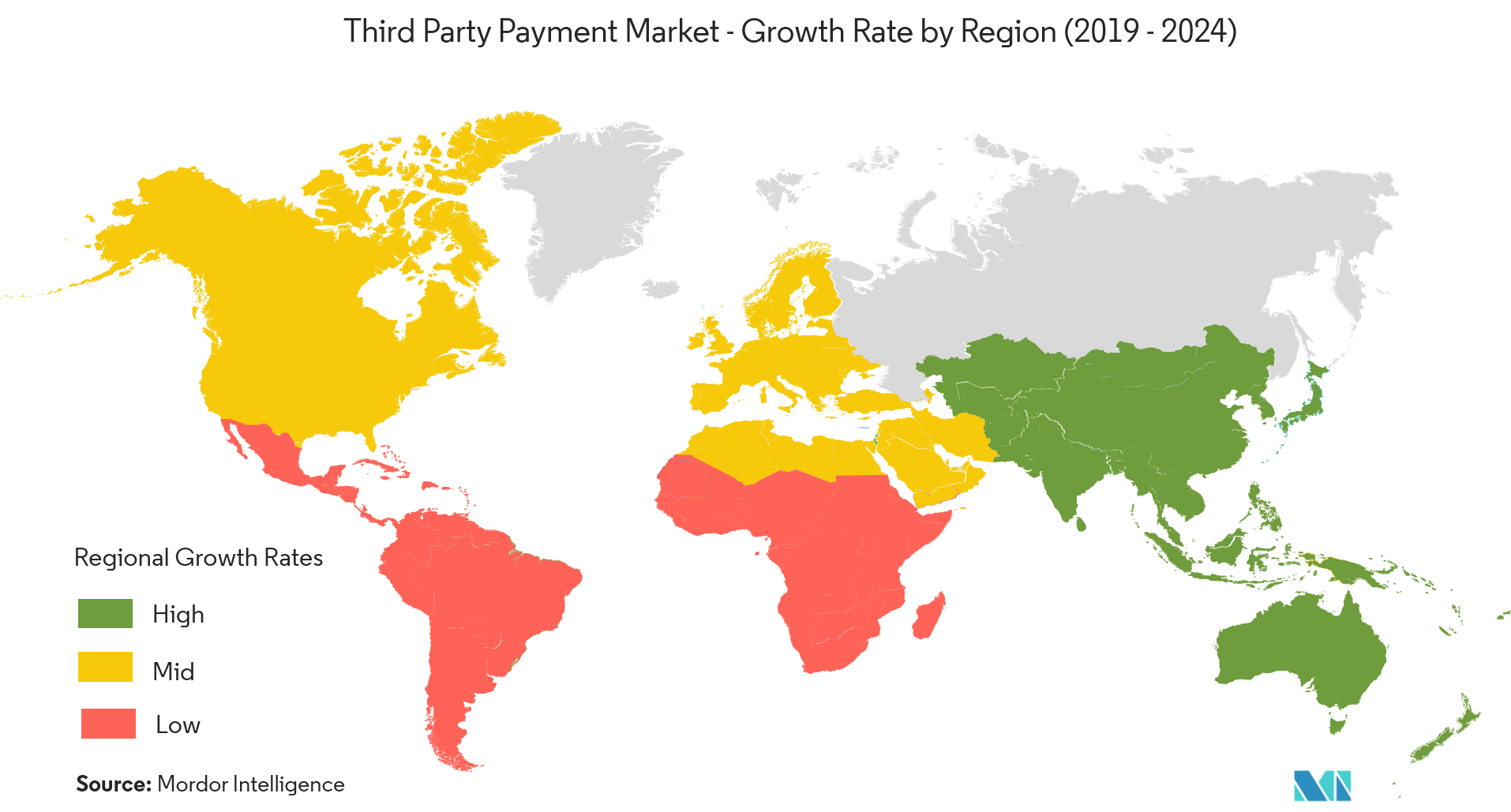

Asia-Pacific is Expected to be the Fastest Growing Market

- Asia leads the payment innovation, particularly in mobile payments. Consumers in Asian markets expect equal measures of seamless ease and security in all facets of their digital lives, more so when it comes to payments and shopping.

- The other factor that is driving the relatively mature APAC market is the government initiatives to promote digital payments. Hence eCommerce, the proliferation of PoS and Government Initiatives remain the three most important factors that shall drive the Third Party Payment Market in Asia-Pacific.

- Going forward the eCommerce market is expected to be defined by extraordinary rates of growth with five-year compound annual growth rates for Malaysia, Vietnam and Philipines & Indonesia projected at 21.3%, 20.2% 18.6% respectively, the WorldPay report stated.

- The contours of regional commerce will be redefined by the proliferation of PoS segment. According to the Global Payments Report, 2018, Taiwan’s Point of Sale is projected to grow at 10%, trailing close behind the expected 11% Point of Sale growth of China.

- Government initiatives are driving Asia’s non-cash transactions. For example, Australia’s payment modernization will be led by the New Payments Platform launched by the government. Singapore has established payments council, PayNow, a standard QR code, cashless public transport, and unified PoS terminals to drive the growth of e-payments.