Market Trends of Semiconductor Memory IP Industry

This section covers the major market trends shaping the Semiconductor Memory IP Market according to our research experts:

Consumer Electronics is Expected to Witness Significant Growth

- The demand for Semiconductor Memory IP increases with the increased adoption rate of DRAM. DRAM is used in laptops, computers, workstations and video game consoles as well. DRAM memories can be used for several purposes such as graphic enhancements, networking, DVDs, Printers, Digital Cameras, Car navigation system, HDDs etc. For Instance, Samsung announced its first 8Gb LPDDR5 DRAM chip for mobile devices.

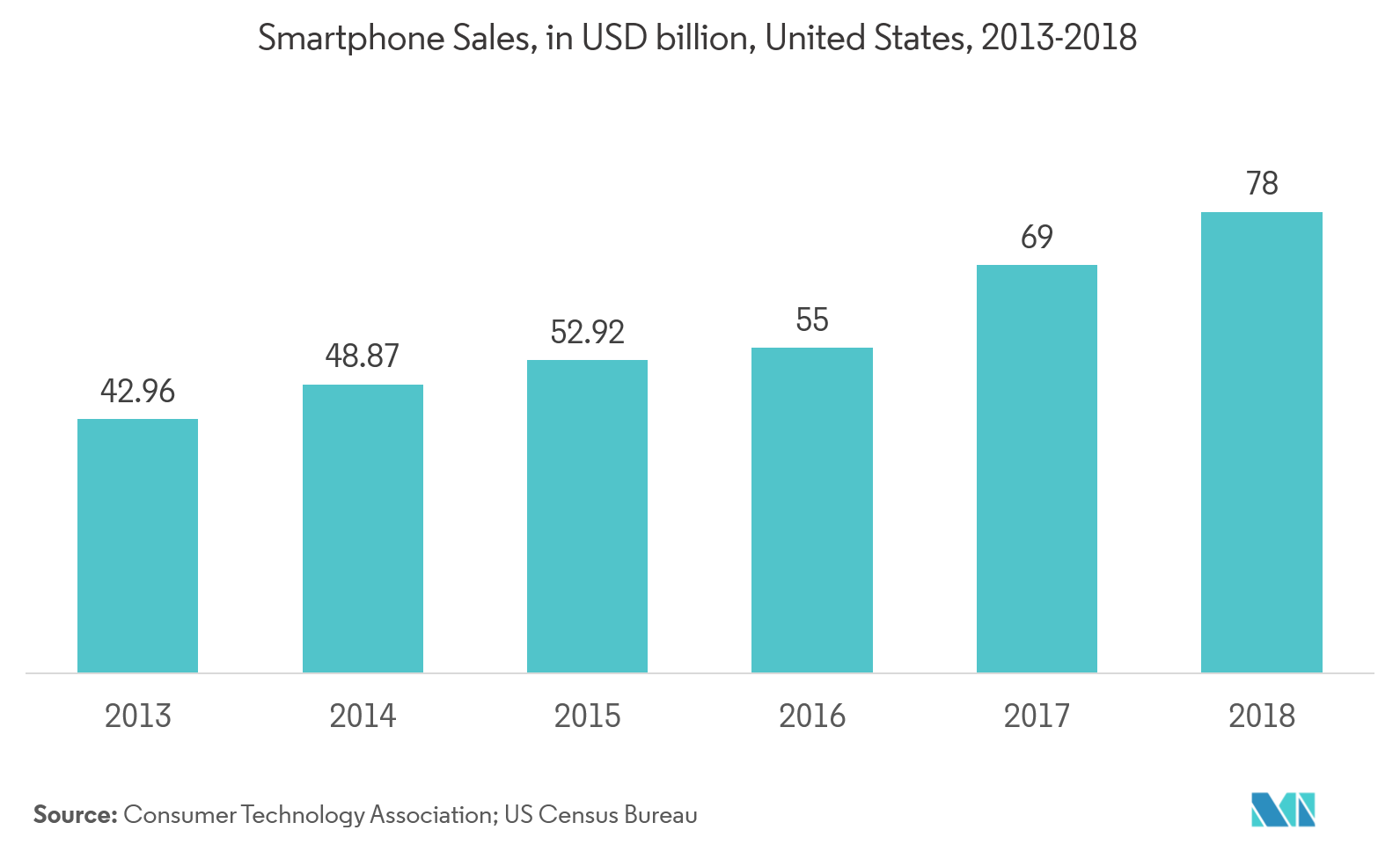

- Smartphones are the major contributor to consumer electronics growth. The technology of semiconductor memory is most prevalent in the smartphone industry. With smartphone sales increasing, there is a huge opportunity for semiconductor memory manufacturers to increase their adoption rates in smartphones.

- As Flash Memory is one of the most prevalent technology in the smartphone industry, Its adoption rate directly affects the impact of semiconductor memory in consumer electronics. Flash memory is widely used in many applications including memory cards for digital cameras, mobile phones, computer memory sticks, and many other applications

- The need and popularity of AI-enabled applications are stoking demand for faster processors, digital memory, and bigger and cheaper storage. CES saw major memory and storage companies demonstrating how they intend to enable the next generation of non-volatile memory and storage. These products included conventional hard disk drives and flash memory, but also included emerging non-volatile memory technologies, such as Resistive RAM (ReRAM) and Magnetic RAM (MRAM). For instance, at CES 2019, Thermaltake officially entered the memory market with two new kits of DDR4 3200 RAM which not only include integrated water blocks but also includes 16.8 million color RGB customization.

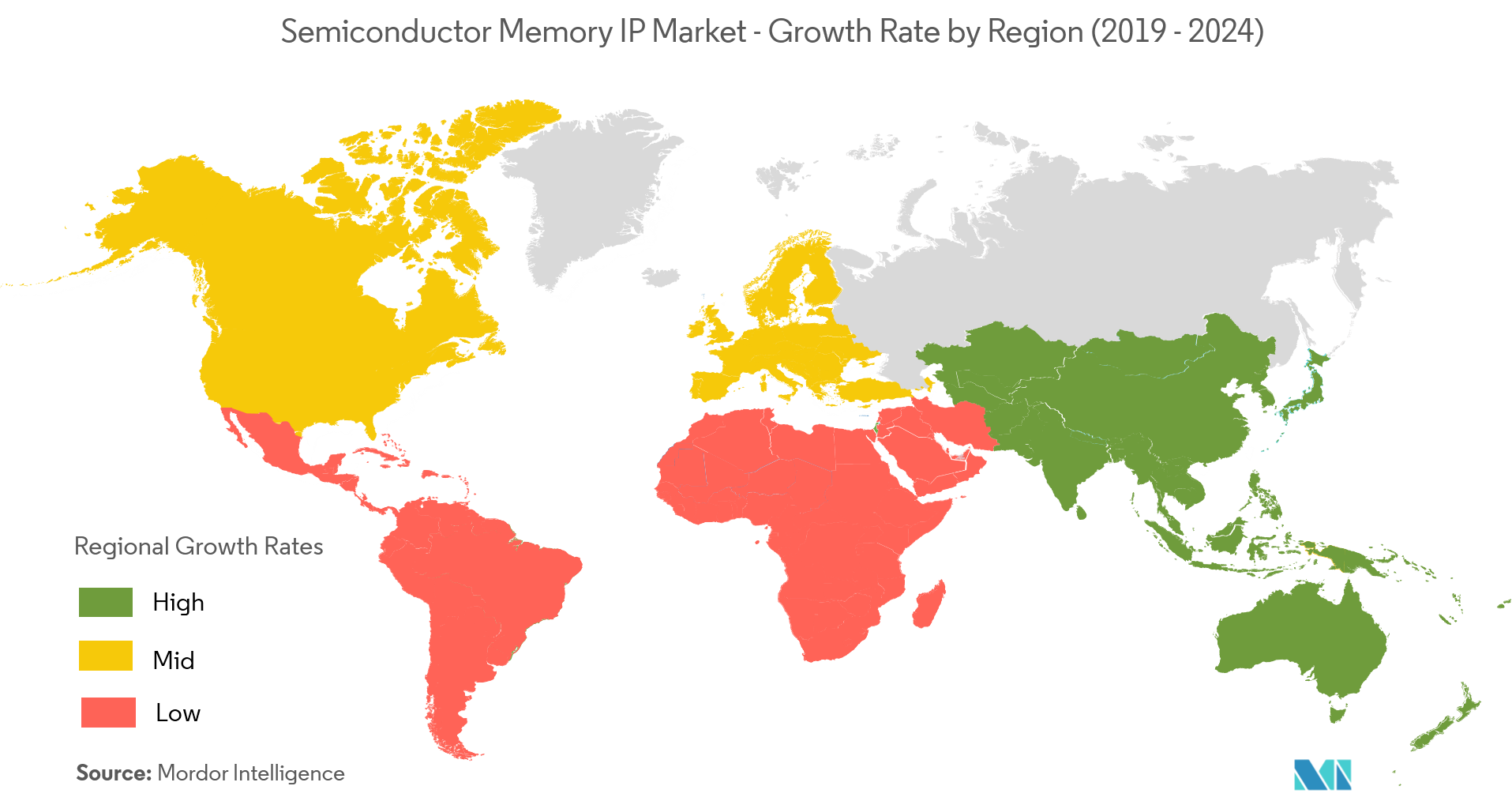

North America is Expected to Hold Significant Market Share

- The growing need for intelligent command and control in many industries in North America is presenting important market opportunities for many superconductor memory manufacturers. For instance, Hitachi, Ltd. and its subsidiary Hitachi America, Ltd., announced the merger of Hitachi America subsidiaries Hitachi Semiconductor (America) Inc., Brisbane, Calif., and Hitachi Micro Systems Inc., San Jose, Calif., to create a unified organization focused on the design, development and marketing of large-scale integrated semiconductor systems to focus greater resources on building a systems solution business in North America, while consolidating high-volume semiconductor production to a unified operating base to achieve greater operating efficiencies.

- According to SEMI, growth of semiconductor market sufferered (0.9% percent lower than the final September 2018 level of USD 2.07 billion, and is 2.0 percent higher than the October 2017 billings level of USD 2.02 billion), Although the growth rate has suffered but it is expected to to rise due to the increased demand of DRAMS as the most efficient semiconductor memory type.

- Due to the increase in number of data centers in the United States, the demand for DRAMS have increased significantly due to the efficiency they provide. The costs of running a data center include many aspects beyond the initial purchase of the base infrastructure. Modern IT organizations realize that a memory and storage hierarchy from DRAM to Solid State Drives (SSDs) to Hard Disk Drives can be an important data center feature that their users will depend on. According to AFCOM, Annual global IP traffic will reach 3.3 zettabytes by 2021. In 2016, global IP traffic was 1.2 ZB per year or 96 exabytes (one billion gigabytes) per month. With the increased amount of data generated.