Market Trends of Safety Drives and Motors Industry

This section covers the major market trends shaping the Safety Drives Motors Market according to our research experts:

Oil & Gas to Occupy the Maximum Market Share

- Electric drives and motors play a major role in the oil & gas production and distribution, pumping systems for oil and compression drive trains for gas infrastructure.

- According to GE, unplanned outages from moto failure can cause a refinery revenue loss of USD 1.1 million for every half hour offline.

- With this, VFDs (Variable Frequency Drives) are increasingly being used in the oil & gas industry to control the flow, by adjusting speed that avoids energy wastage in the throttling valves.

- France-based Leroy Somer is a pioneer in drive system for oil & gas supply chain. Some of their products are Dyneo® Permanent Magnet Synchronous Motors, ATEX Dust and Gas Safety Motors, Powerdrive MD2 AC Drives which are known for offering reliability, robustness, efficiency and flexibility.

- GE is providing a complete solution to drive the main refrigerant compressors using electrical motors (synchronous or induction) powered by high-power drives based on thyristor technology (for LCI) or IGBT technology. This would assist LNG supply chain in processing, transport and distribution network.

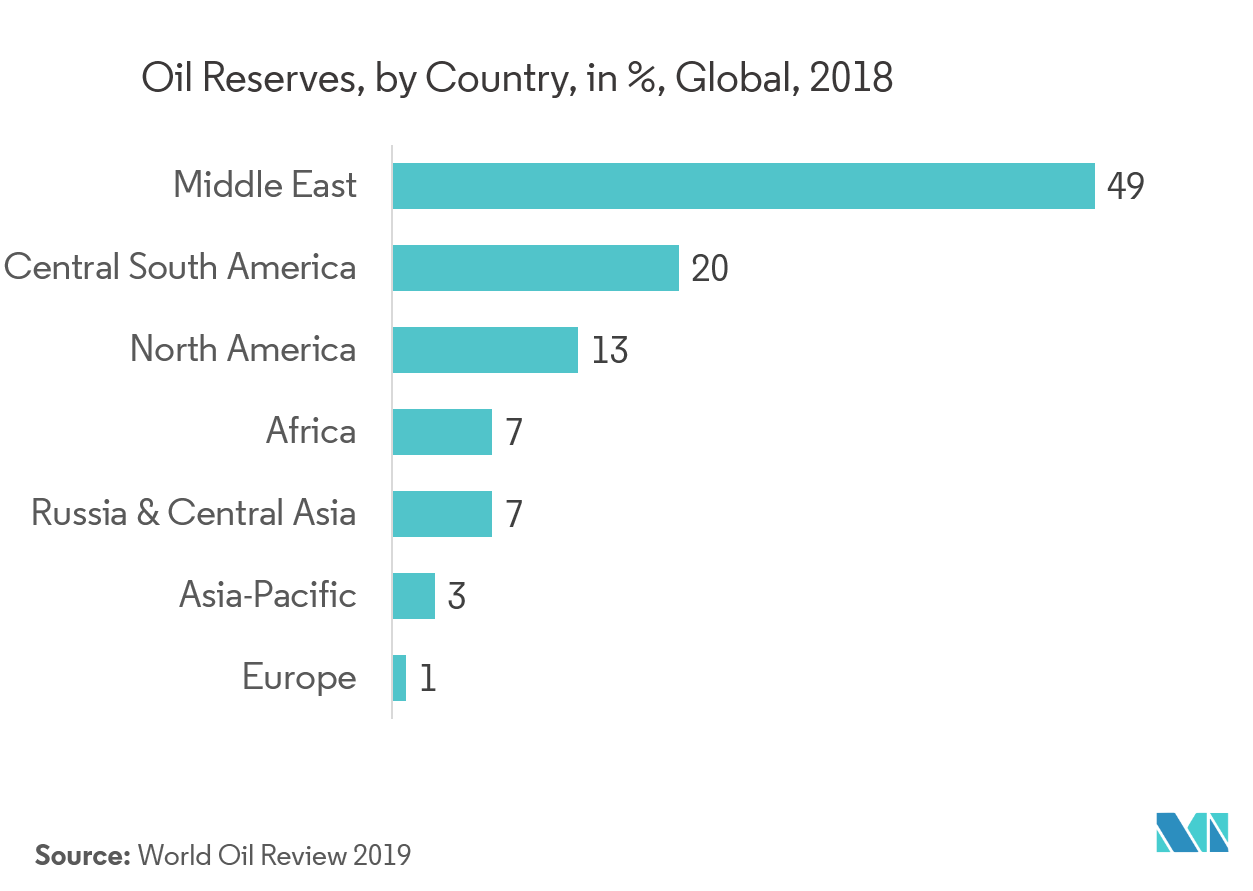

- There are many active and planned project work in the oil and gas sector across the Middle East, which is the largest producer of oil & gas.

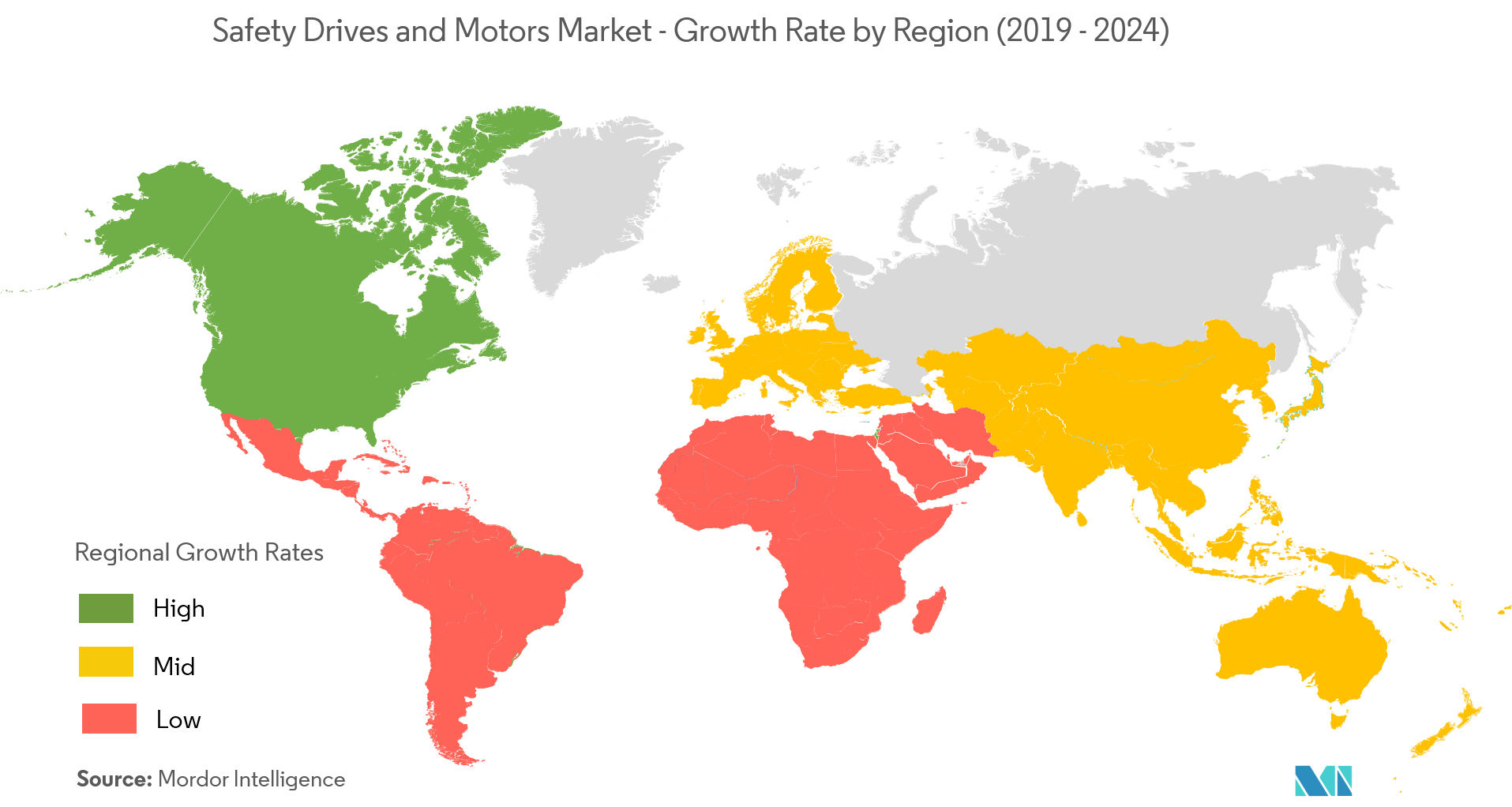

North America to Occupy Major Market Share

- North America is one of the largest markets for safety drives and motors globally. The region has a high demand form the upstream oil and gas sector and industrial segment. In fact it is one of the largest adopter of industry 4.0 policies in the world. Additionally, the US government’s policies to increase production and depend less on exports is expected to be the primary driver for demand from the industrial sector.

- According to BP Statistical Review of World Energy 2019, global oil production rose by 2.2 million b/d. Maximum net increase was accounted for by the US, with their growth in production of 2.2 million b/d. Growth in gas consumption was also driven by the United States at 78 bcm.

- Moreover, with the United States Department of the Interior (DoI) planning to allow offshore exploratory drilling in about 90% of the outer continental shelf (OCS) acreage, under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open up new opportunities to the market.

- However declining mining industry in Canada is restraining the market growth in this region. According to the Mining Association of Canada, value of total mining projects planned and under construction from 2018 to 2028 has reduced by 55% since 2014. This was due to an increasing interest in Canada’s emerging cannabis sector, which gained attention after recreational use of marijuana was legalized in October 2018.