Market Trends of Motor Insurance Industry

This section covers the major market trends shaping the Motor Insurance Market according to our research experts:

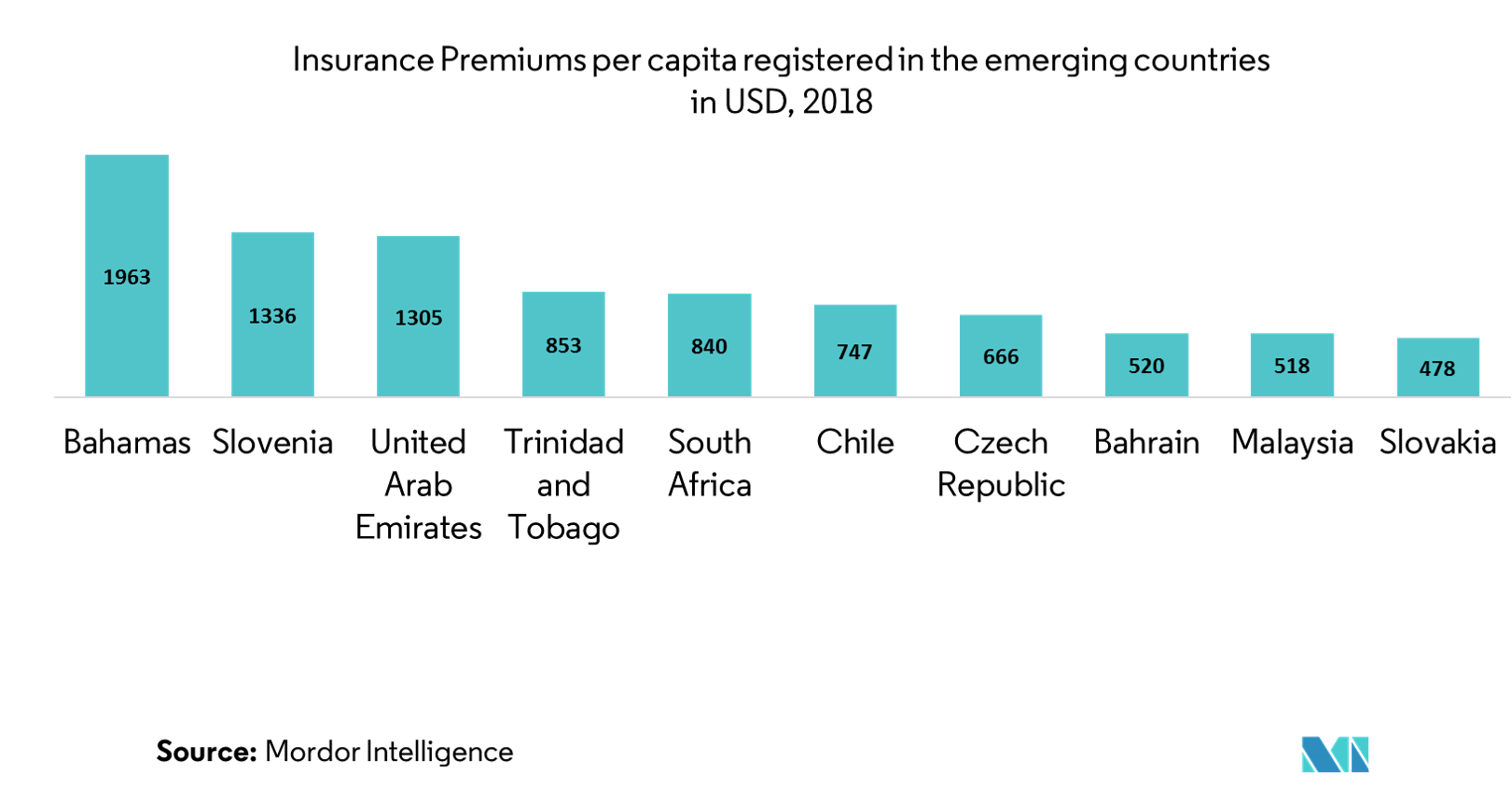

Emerging Countries Driving the Market Growth

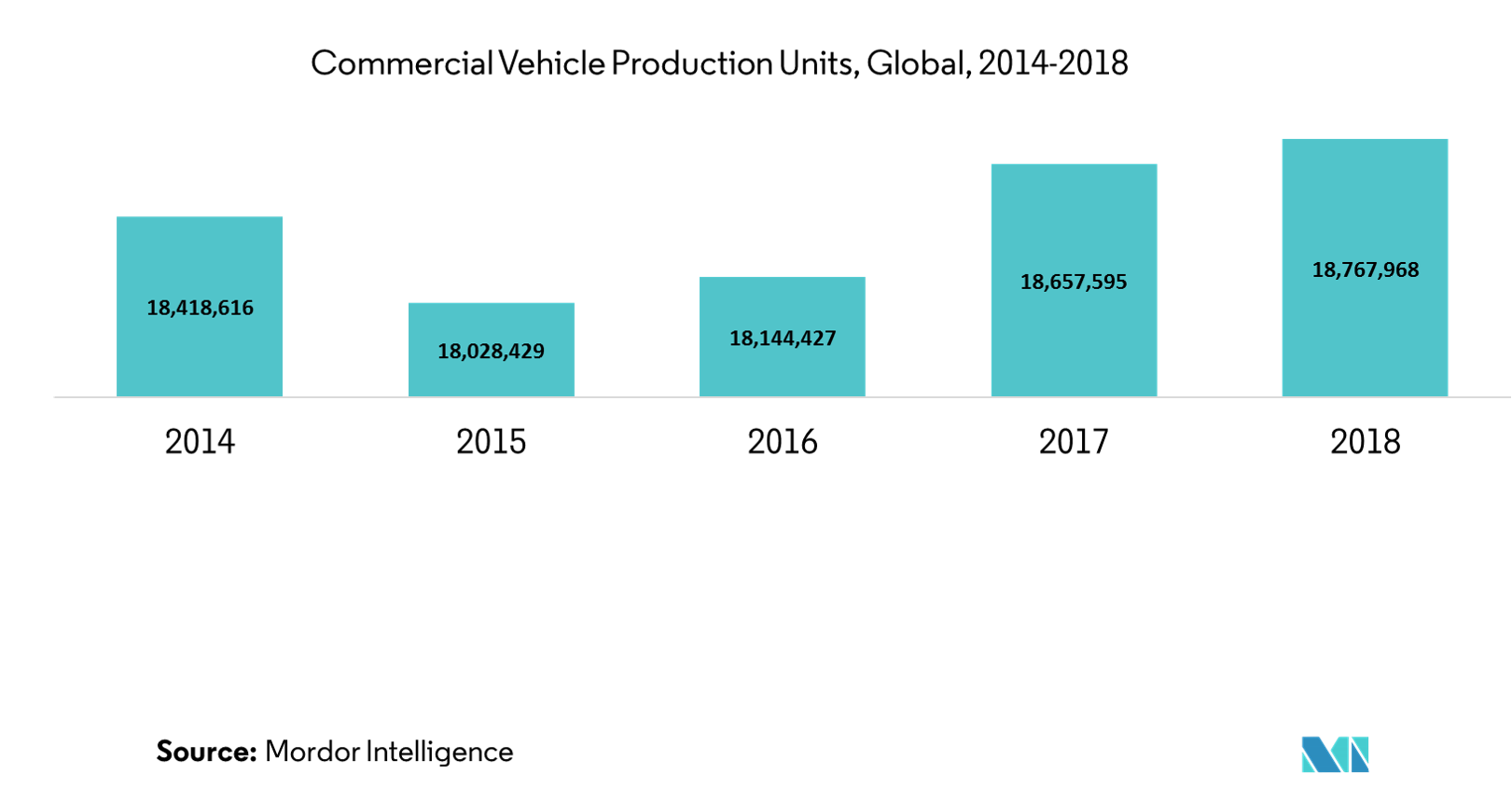

Growth opportunities in the Commercial Fleet Market

- Commercial vehicle sales in China were down 13%, reflecting 351,000 units, according to the China Association of Automobile Manufacturers (CAAM). Meanwhile, commercial vehicle production was also down: 8.8% month over month and down 8.5% year-over-year.

- The number of commercial vehicles sold in South Korea rose steadily from 2012 to 2015 (from 234,000 to 262,000) but took a slight dip in 2016 to 256,000. That number rose again in 2017 to 263,000 and was tracked at 60,000 vehicles, in March 2018.

- Commercial fleet registrations in Germany increased by 14.9% in July and also helped the new passenger car segment achieve its best month since 2009.

- Registrations of light commercial vehicles (LCVs) in Brazil were up 15.6% in May 2019, compared to the same time last year, and were also up by 9.9%, year-to-date. Truck registrations were also up significantly, comparing the numbers in May 2019 to the same time last year, up by 62.2%. Registrations for this segment were also up, year-to-date, 48.5%. When broken down by fuel type, sales of flexible-fuel vehicles were up 21.6%, year-over-year, and diesel vehicles were up 21.5% from a year ago. Hybrid and electric vehicles increased by 18.2% to 357 units, while, gasoline vehicles decreased 16% to 6,196 units.

It was observed that, globally, the fleet sizes and sales fluctuated in 2018 and 2019. But due to the increasing technology integration in commercial fleets insurance, the market has witnessed positive growth.