Market Trends of Inertial Systems Industry in Energy and Infrastructure

This section covers the major market trends shaping the Energy & Infrastructure Inertial Systems Market according to our research experts:

MEMs to Hold Significant Market Growth in the Oil and Gas Sector

- In the oil and gas industry, exploration and survey are one of the most important tasks. Computers, with the help of MEMs and other supplementing equipment, aid the exploration activity in the ocean. In deep oceans, getting real-time measurements of various parameters is critical and important for a company to decide to go ahead or drop the activity.

- In recent years, microelectromechanical system (MEMS) sensors have been extensively used in navigation fields due to their small size, rigidity, and low-cost consumption. Thus, MEMS-based MWD technology has gained much attention and can potentially be applied in very small diameter well drilling activities in the oil and gas sector with satisfactory precision.

- Stand-alone MEMS-based SINS (strap-down inertial navigation system) provides a short-term accurate navigation solution. Therefore, the following aiding information is also used as updates for the MEMS-based SINS in the drilling procedure. This system provides benefits in the growth of the MEMs for intertial system.

- The new GyroSphere MEMS gyro service from Schlumberger, the United States, delivers all three benefits to operators. Unlike any other gyro-surveying-while-drilling offer in the oilfield at present, the service delivers more transparent gyro-surveying data that increases drilling operation efficiency and tool reliability while improving access to small-target reservoirs.

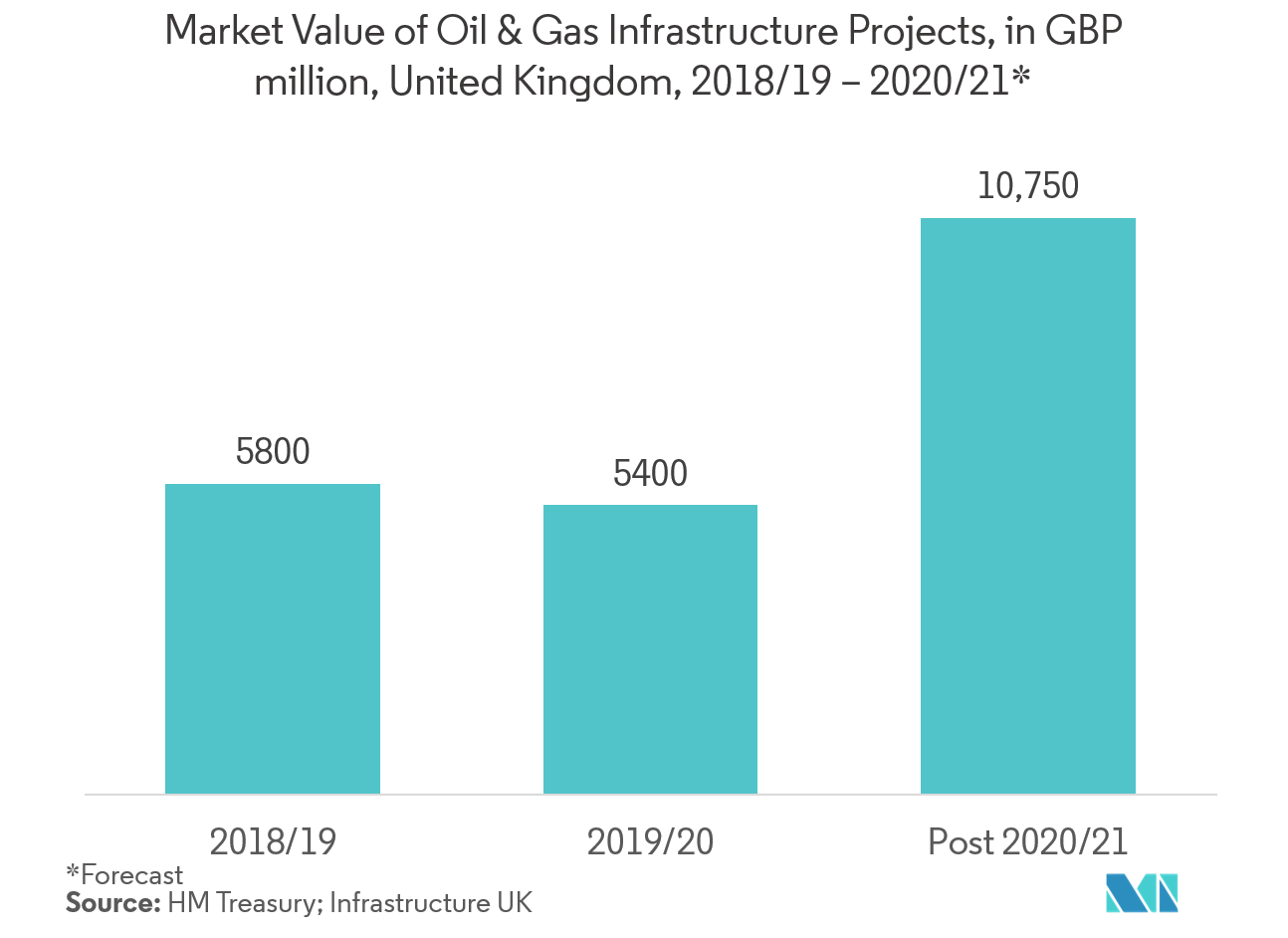

- The oil and gas industry in the United Kingdom make 1.42 million BOE (barrel of oil equivalent) per day. Also, about 98% of production comes from offshore fields and the services industry in Aberdeen has been a leader in developing technology for hydrocarbon extraction offshore. Due to its increasing market value in the future for oil and gas construction, the demand for MMEs will increase highly for inertial system.

- The United States's Department of the Interior (DoI) is planning to allow offshore exploratory drilling in about 90% of the Outer Continental Shelf (OCS) acreage. Under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open upnew opportunities to the market.

North America Witness Significant Market Share

- North America accounted for the maximum share in the market, with the United States contributing the most significantly. The foremost demand for inertial systems in the region comes from the maritime sector, owing to the renewed emphasis on oil exploration activities. The exploration activities of oil rigs require high-performance gyroscopes, IMUs, and accelerometers to provide a right self-contained sensing system and highly accurate solutions for platform stabilization.

- The region is witnessing a growth in the development of new high-performance accelerometers as companies in this region are investing in introducing advanced and innovative accelerometers. The increased spending by the energy sector is the major factor driving the growth of accelerometers in the region.

- Investment in surface and lease equipment necessary for onshore wells and production platforms in the Gulf of Mexico may lead to the growth of the inertial systems market in this region.

- Increase in the number of applications and technological advancements, across the region, provides lucrative opportunities to the inertial systems. Overall, competitive rivalry among the existing competitors is high. Hence, the vendors are keen on increasing their spending on R&D and product portfolio enhancement, in order to increase their market shares.