Market Trends of China Waste Management Industry

This section covers the major market trends shaping the China Waste Management Market according to our research experts:

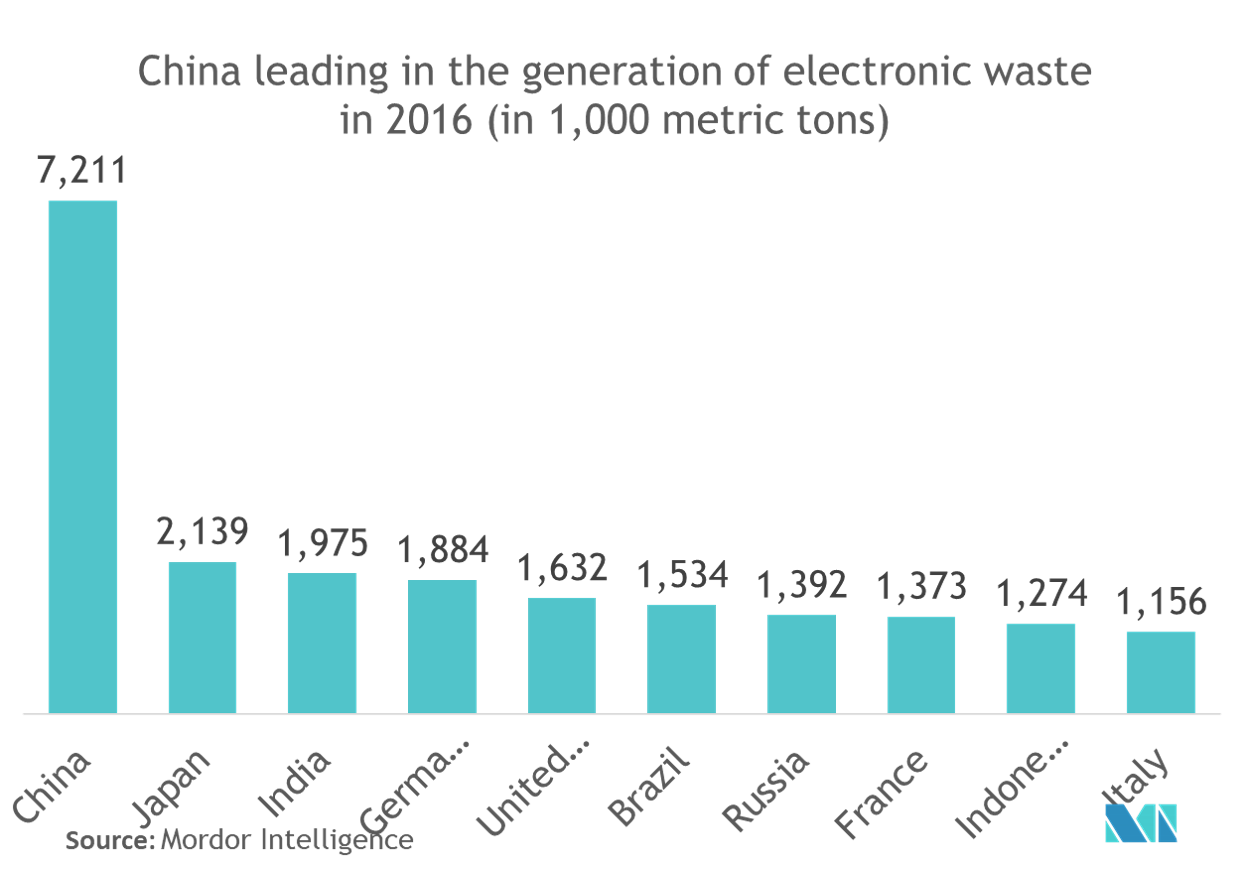

Spotlight on the China e-waste generation and its effective management

China is the leading manufacturer and consumer of electronic products in the world that leads to huge amounts of e-waste generation. The processes involved in the treatment and recycling of the e-wastes had in the past resulted in severe adverse environmental and human health impacts in China. Thus, e-waste management in China needs wide attention to address these issues. In the recent years, central and local governments have made sincere efforts to improve the waste management China. North America is a leading exporter of electronic waste to China as well as Japan.

Importance of recycling increasing rapidly all over China compared to the traditional dumping landfills

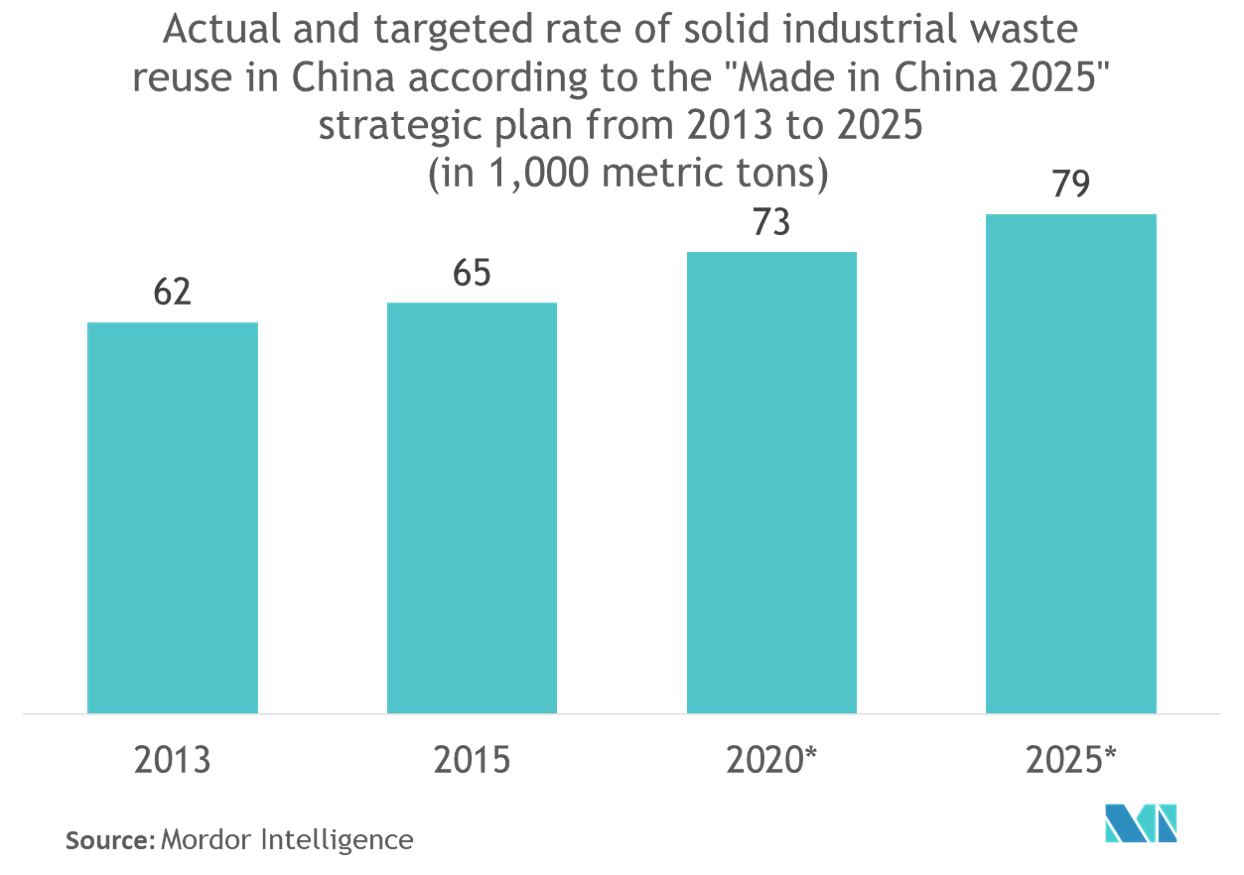

China’s private waste collectors are fast and highly efficient at recycling – sending tons of household waste back to manufacturers. Recycling in China is not subsidized by cities and is driven by the economic value of materials. If the material waste has value, it will somehow find its way to a manufacturer. Plastic, Metal, and electronics are the most recycled materials in China for which most of the enterprises both public and private keep on innovating in terms of the latest technologies to address the needs of the growing waste generated from various industries. The amount of available scrap metal has increased in China and will continue to grow in the future. Soon, China will become a net exporter of scrap metal. For instance, the annual sales of passenger vehicles sold in China had increased from nearly 10 million to 25 million from 2009 to 2018. All these cars are required to be recycled at the end of their lives. The most advanced metal scrap recycling areas are situated in the eastern coastal region from Guangzhou in the south, right up to Beijing and Tianjin in northern China. In 2015, approximately 65% of all the solid industrial waste in China was reused, yet the goal of the "Made in China 2025" plan was to increase the recycling rate by up to 79 percent by 2025.