Market Trends of Ampoules and Blister Packaging Industry

This section covers the major market trends shaping the Ampoules & Blister Packaging Market according to our research experts:

Pharmaceutical and Healthcare Segment to Hold the Largest Share

- Strengthening compliance rates is a goal of the pharmaceutical industry, and ampoules and blister packaging have been shown to have a positive effect on patient compliance and medication adherence. Moreover, ampoules and blisters are highly valued for protective properties, adaptability, and cost-effectiveness, and requirements of the pharmaceutical & healthcare packaging industry.

- In the USA, 90% of the prescription have generic drugs but only generates 28% of the revenue of the pharmaceutical revenue resulting in increasing demand for protective packaging solutions.

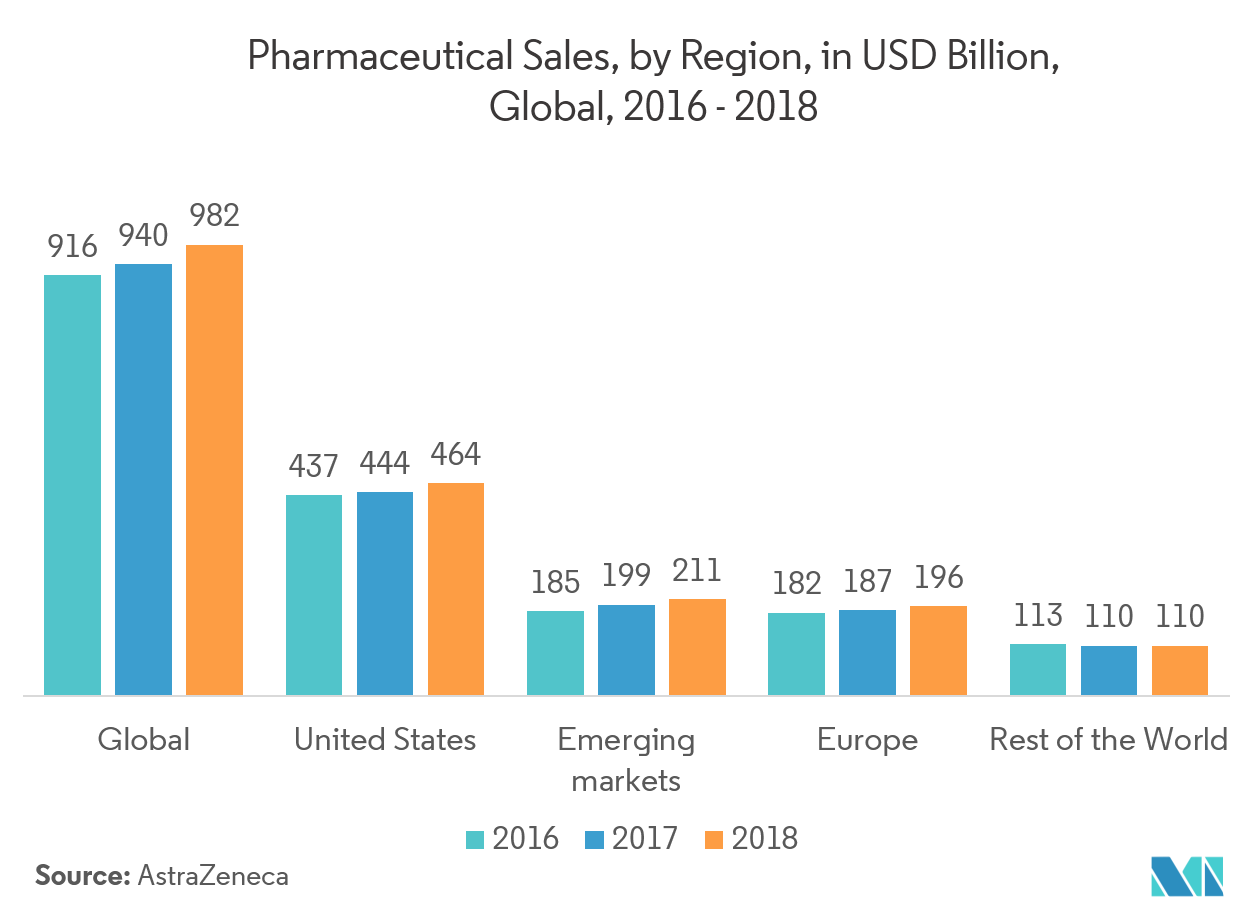

- The global pharmaceutical sales have reached USD 982 billion in the year 2018 in which the united states lead with USD 464 billion followed by emerging markets like Asia-Pacific region.

- However, owing to increase diseases and infections, the demand for ampoules and blisters are compelling the manufacturers, to venture into new machinery to increase the production of the ampoules and blisters, thus, creating a significant investment challenge for them.

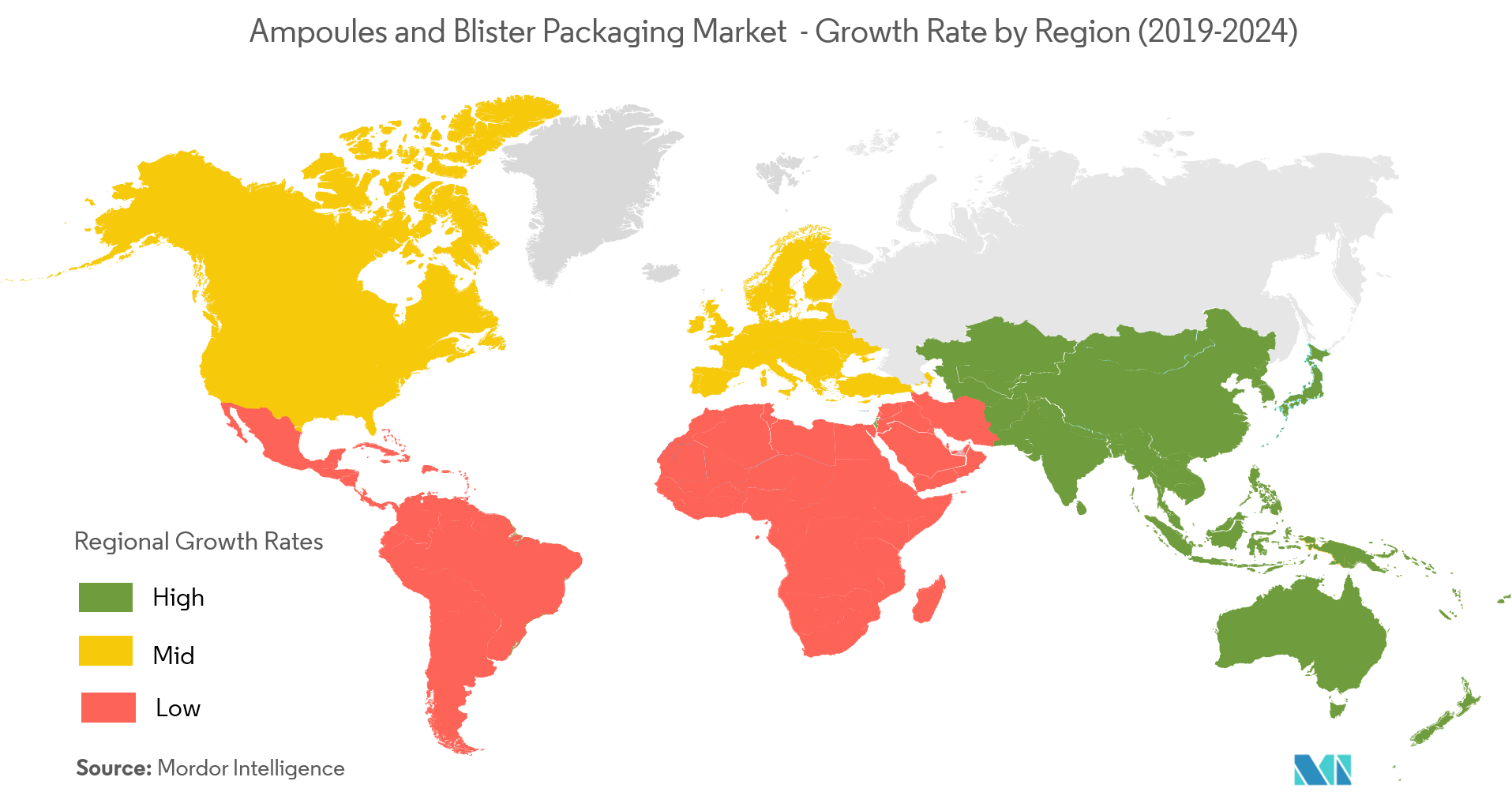

Europe Expected to Grow Significantly

- The increasing incorporation of sustainable materials, like green plastics and other biodegradable materials in the manufacturing of ampoules and blisters, is likely to provide significant momentum to the European ampoules and blisters market in the forecast period.

- This ready-to-use packaging solution facilitates pharmaceutical companies to react faster to new industry trends without building specific manufacturing capabilities. To serve the growing demand, major companies like SCHOTT invested EUR 12 million in a newly established manufacturing plant in Russia, which approximately serves 500 million vials and ampoules every year.

- The European community has stronger environmental incentives to use ampoules and blister packaging, because of the stringent regulations over the manufactures in using excess material in the packaging system. The use of ampoules and blister packaging allows manufacturers to reduce packages to a minimal size. In Europe, the UK pharmaceutical industry is one of the major engines of innovation and research.

- The industry spends billions on R&D and employs vast numbers for highly skilled R&D roles. These massive investments and the proportion of skilled workers employed show how the United Kingdom is building up the pipeline of medicines and future drugs. These active investments can be seen as an excellent opportunity for the growth of ampoules and blister packaging market in the country.