Market Trends of Alternator Industry

This section covers the major market trends shaping the Alternator Market according to our research experts:

Application in Oil & Gas is Expected to Hold a Significant Share

- Oil and gas projects typically require alternators in the 500kW-25MW range. In Offshore, alternators are used in drilling rigs support vessels providing prime power, drilling operation, and platform propulsion when used on the floating rigs.

- The search for oil often leads to extreme conditions, either on the sea or on land, where dusty desert conditions or offshore platforms can affect an alternator's performance. Thereby, vendors are providing total environmental protection, delivering the reliability and durability demanded by the customers and designed to suit oil & gas project.

- For instance, a continuous power requirement in Colombia’s oil sector is being met by Stamford P80 alternators., provided by Cummins Generator Technologies. Specialist generator set manufacturer IGSA from Mexico specified the premium alternators from Cummins Generator Technologies. These were coupled with Cummins engines to make a 2.5MW generator set design that meets the highest quality standards in a demanding application. The alternators specified were low voltage variants of the Stamford P80 range.

- According to the Colombian Petroleum Association, Oil companies Operating in Colombia invested USD 4.35 billion in 2018, most of which went into production and some USD 800 million into exploration.

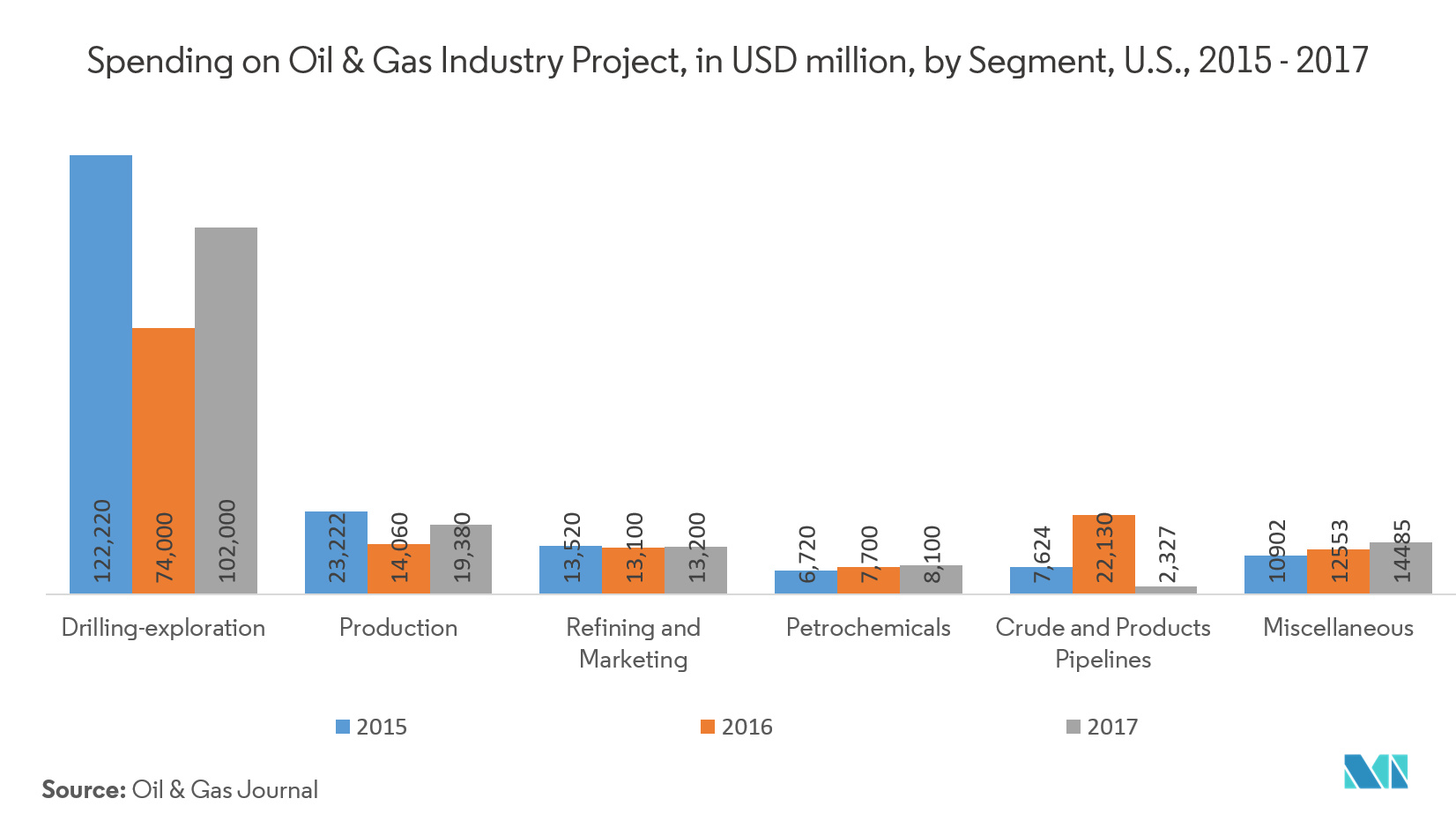

- Increasing offshore and onshore oil and gas projects in the United States owing to the National OCS leasing program, are expected to increase the demand for alternators over the forecast period.

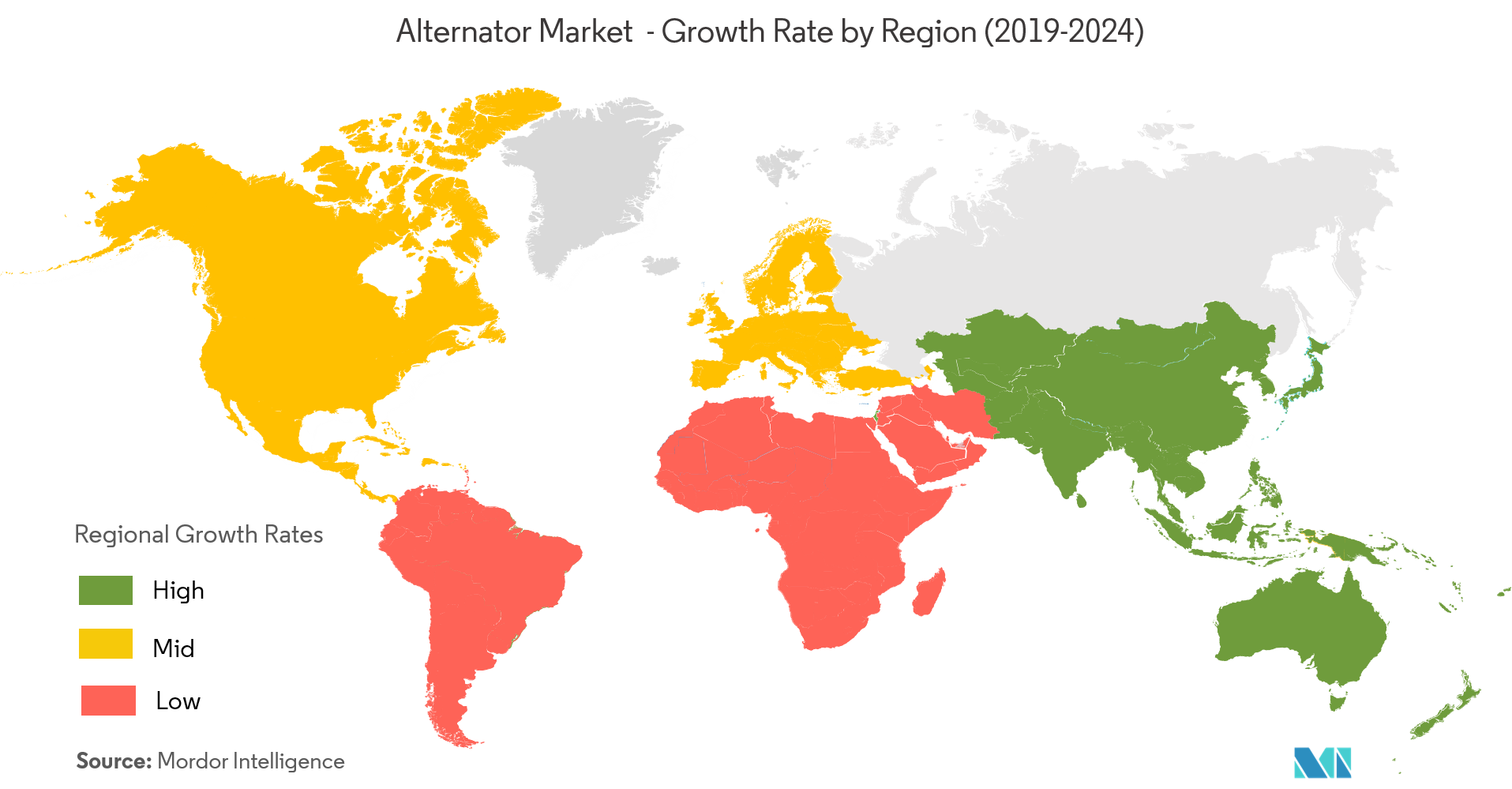

Asia-Pacific is Expected to Provide Lucrative Growth Opportunities and Witness Highest Growth Rate

- Economic growth, urbanization, and the need for electrification have boosted the growth of alternator in the Asia-Pacific region. Countries such as India, China, and Japan are witnessing an increase in demand for alternator from power generation, cogeneration, and industrial sectors.

- Moreover, the Chinese government launched 'New-Type Urbanization Plan', focusing primarily on new-type, smart, and humanities city construction from 2014 – 2020. Additionally, Japan is attracting diverse companies to invest in data centers. In February 2018, Google announced to launch a second cloud platform data center in Japan. For instance, In February 2018, Google announced to launch a second cloud platform data center in Japan.

- The growth of the automotive industry in Asia-Pacific countries such as India, Japan, and South Korea among others is boosting the adoption of the alternator. The manufacturing sector has been one of ASEAN’s key economic growth drivers. The economies in the region have low operating costs which attract businesses from larger manufacturing bases.

- A company such as DENSO announced that it has developed a high-efficiency diode for alternators for gasoline and diesel engine vehicles with the semiconductor supplier, Hitachi Power Semiconductor Device, Ltd. The jointly developed diode significantly reduces the power conversion loss by increasing the efficiency of the function.