Textile Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 748.00 Billion |

| Market Size (2029) | USD 889.24 Billion |

| CAGR (2024 - 2029) | 3.52 % |

| Fastest Growing Market | North America |

| Largest Market | Asia Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Textile Market Analysis

The Textile Market size is estimated at USD 748 billion in 2024, and is expected to reach USD 889.24 billion by 2029, growing at a CAGR of 3.52% during the forecast period (2024-2029).

The COVID-19 pandemic has challenged the textile industry drastically in 2020. Asia, which is one of the largest markets for the textile industry in the world, has suffered from the prolonged lockdowns and restrictions in the majority of Asian countries along with the sudden drop in international demand for their products. The loss was particularly high in countries where the textile industry accounted for a larger share of the exports. According to the study by the International Labour Organization (ILO) the global textile trade collapsed during the first half of 2020. Also, exports to the major buying regions in the European Union, the United States, and Japan fell by around 70%. The industry also suffered several supply chain disruptions due to the shortages of cotton and other raw materials.

The textile industry is an ever-growing market, with key competitors being China, the European Union, the United States, and India. China is the world's leading producer and exporter of both raw textiles and garments. The United States is the leading producer and exporter of raw cotton, while also being the top importer of raw textiles and garments. The textile industry of the European Union comprises Germany, Spain, France, Italy, and Portugal at the forefront with a value of more than 1/5th of the global textile industry. India is the third-largest textile manufacturing industry and is responsible for more than 6% of the total textile production, globally. The rapid industrialization in the developed and developing countries and the evolving technology are helping the textile industry to have modern installations which are capable of high-efficient fabric production. These factors are helping the textile industry to record more revenues during the study period and are expected to help the industry further in the forecast period.

Textile Market Trends

This section covers the major market trends shaping the Textile Market according to our research experts:

Increasing Demand for Natural Fibers

Natural fiber composites are relatively lighter and have more strength than conventional fibers, and therefore, find extensive application in the automotive industry for interior and exterior applications. Natural fibers obtained from plants and animals include cotton, silk, linen, wool, hemp, jute, and cashmere. These fibers are widely used to manufacture garments, apparel, construction materials, medical dressings, and interiors of automobiles, among others. The abundance of natural fibers, especially cotton, in China, India, and the United States, is contributing significantly to the growth of the global textile market. Silk is used in upholstery and apparel, as it is available in both variations fine as well as coarse. Wool and jute are used as textile materials for their resilience, elasticity, and softness. The increasing consumption of natural fibers, such as cotton, silk, wool, and jute, will drive the global textile market during the forecast period.

Shifting Focus Toward Non-woven Fabrics

The increasing birth rate and aging population has contributed to the growing demand for hygiene products, such as baby diapers, sanitary napkins, and adult incontinence products, which, in turn, is expected to fuel the demand for non-woven fabrics. Nonwovens are used in road construction in the form of geotextiles to increase the durability of roads. Low maintenance costs associated with nonwovens are expected to fuel its demand in construction applications. The positive outlook of the automobile and transportation industry, globally, is further expected to propel growth for the non-woven fabric market over the next years. The automobile industry manufactures a large number of exterior and interior parts using non-woven fabrics owing to their durability. Rapid industrialization and recent innovations in the field of textile technology are other factors fueling demand for non-woven fabrics, globally.

Textile Industry Overview

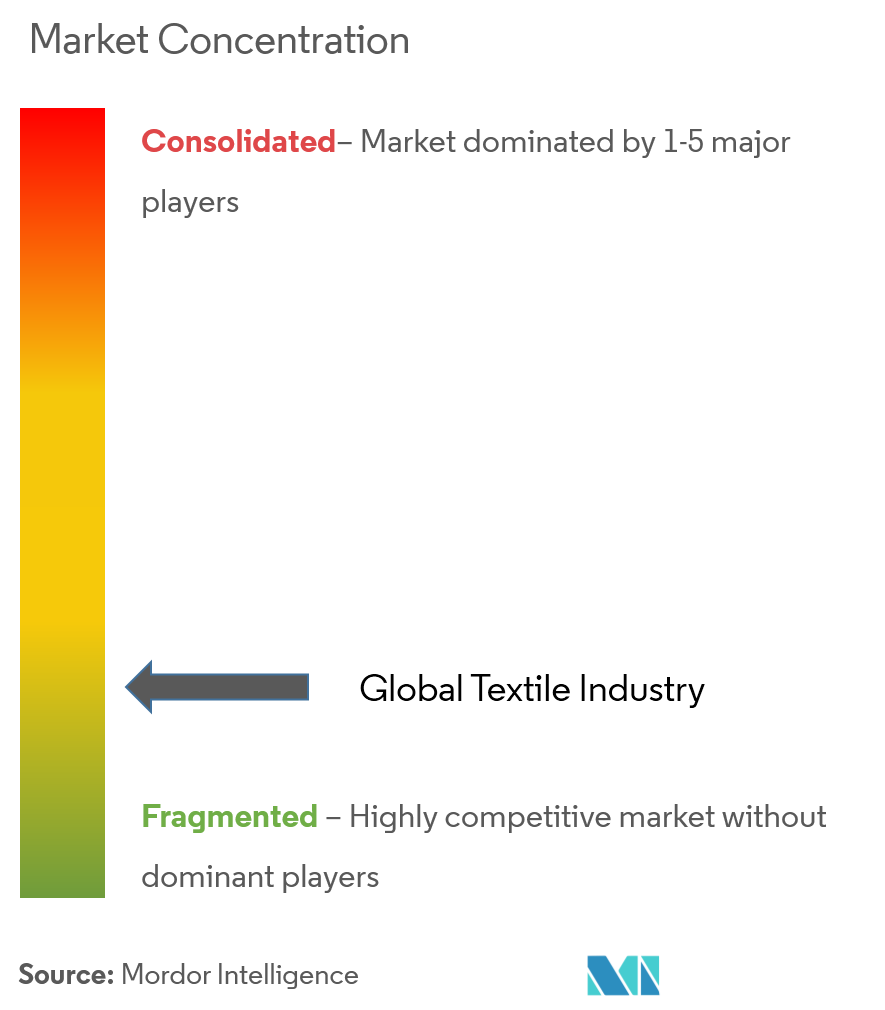

The report covers the major players operating in the textile industry. In terms of market share, the companies in the global textile industry do not have a considerable amount of market share, as the market is highly competitive and fragmented.

Textile Market Leaders

Toray Industries Inc.

B.C. Corporation

Inditex SA

Shandong Weiqiao Pioneering Group Company Limited

Nisshinbo Holdings Inc.

*Disclaimer: Major Players sorted in no particular order

Textile Market News

- In Feb 2021, The Indian Government has announced the setting up of seven mega textile parks in the next three years. The government has also decided to rationalize the duties on raw material inputs to manmade textiles by reducing the customs duty rate on caprolactam, nylon chips, and nylon fiber and yarn to 5 %.

- In Feb 2021, Paraguay's Ministry of Industry and Commerce announced that it will be investing USD 1.1 million in the manufacturing sector, mainly benefiting the clothing, textiles, and footwear industries, among other areas related to assembly operations.

Textile Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints/Challenges

4.4 Market Opportunities

4.5 Value Chain / Supply Chain Analysis

4.6 Industry Attractiveness - Porter's Five Forces Analysis

4.7 Technological Innovation in the Industry

4.8 Impact of COVID-19 on the Textile Industry

5. MARKET SEGMENTATION

5.1 Application

5.1.1 Clothing Application

5.1.2 Industrial/Technical Application

5.1.3 Household Application

5.2 Material

5.2.1 Cotton

5.2.2 Jute

5.2.3 Silk

5.2.4 Synthetics

5.2.5 Wool

5.3 Process

5.3.1 Woven

5.3.2 Non-woven

5.4 Geography

5.4.1 North America

5.4.2 Europe

5.4.3 Asia-Pacific

5.4.4 Latin America

5.4.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

6.1 Market Competition Overview

6.2 Company Profiles

6.2.1 Toray Industries Inc.

6.2.2 B.C. Corporation

6.2.3 Industria de Diseno Textil SA (Inditex SA)

6.2.4 Shandong Weiqiao Pioneering Group Company Limited

6.2.5 Nisshinbo Holdings Inc.

6.2.6 Chori Co. Ltd

6.2.7 Texhong Textile Group Ltd.

6.2.8 Aditya Birla Nuvo Ltd

6.2.9 Hyosung TNC Corp.

6.2.10 PVH Corp.

6.2.11 Far Eastern New Century Corp

6.2.12 Arvind Ltd*

- *List Not Exhaustive

7. FUTURE OF THE MARKET

8. DISCLAIMER

Textile Industry Segmentation

The report aims to provide a detailed analysis of the global textile industry. It focuses on market dynamics, technological trends, and insights on the geographical segments and the process, material, and application types. Also, it analyses the major players and the competitive landscape in the global textile industry. The Textile Industry is Segmented by Application Type (Clothing, Industrial/Technical Applications, and Household Applications), By Material (Cotton, Jute, Silk, Synthetics, and Wool), by Process ( Woven and Non-woven), and by Geography (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa). The report offers market size and forecasts for the textile industry in Value (USD billion) for all the above segments.

| Application | |

| Clothing Application | |

| Industrial/Technical Application | |

| Household Application |

| Material | |

| Cotton | |

| Jute | |

| Silk | |

| Synthetics | |

| Wool |

| Process | |

| Woven | |

| Non-woven |

| Geography | |

| North America | |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Textile Market Research FAQs

How big is the Textile Market?

The Textile Market size is expected to reach USD 748.00 billion in 2024 and grow at a CAGR of 3.52% to reach USD 889.24 billion by 2029.

What is the current Textile Market size?

In 2024, the Textile Market size is expected to reach USD 748.00 billion.

Who are the key players in Textile Market?

Toray Industries Inc., B.C. Corporation, Inditex SA, Shandong Weiqiao Pioneering Group Company Limited and Nisshinbo Holdings Inc. are the major companies operating in the Textile Market.

Which is the fastest growing region in Textile Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Textile Market?

In 2024, the Asia Pacific accounts for the largest market share in Textile Market.

What years does this Textile Market cover, and what was the market size in 2023?

In 2023, the Textile Market size was estimated at USD 722.57 billion. The report covers the Textile Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Textile Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Textile Industry Report

Statistics for the 2024 Textile market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Textile analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.