UCaaS Manufacturing Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 17.74 % |

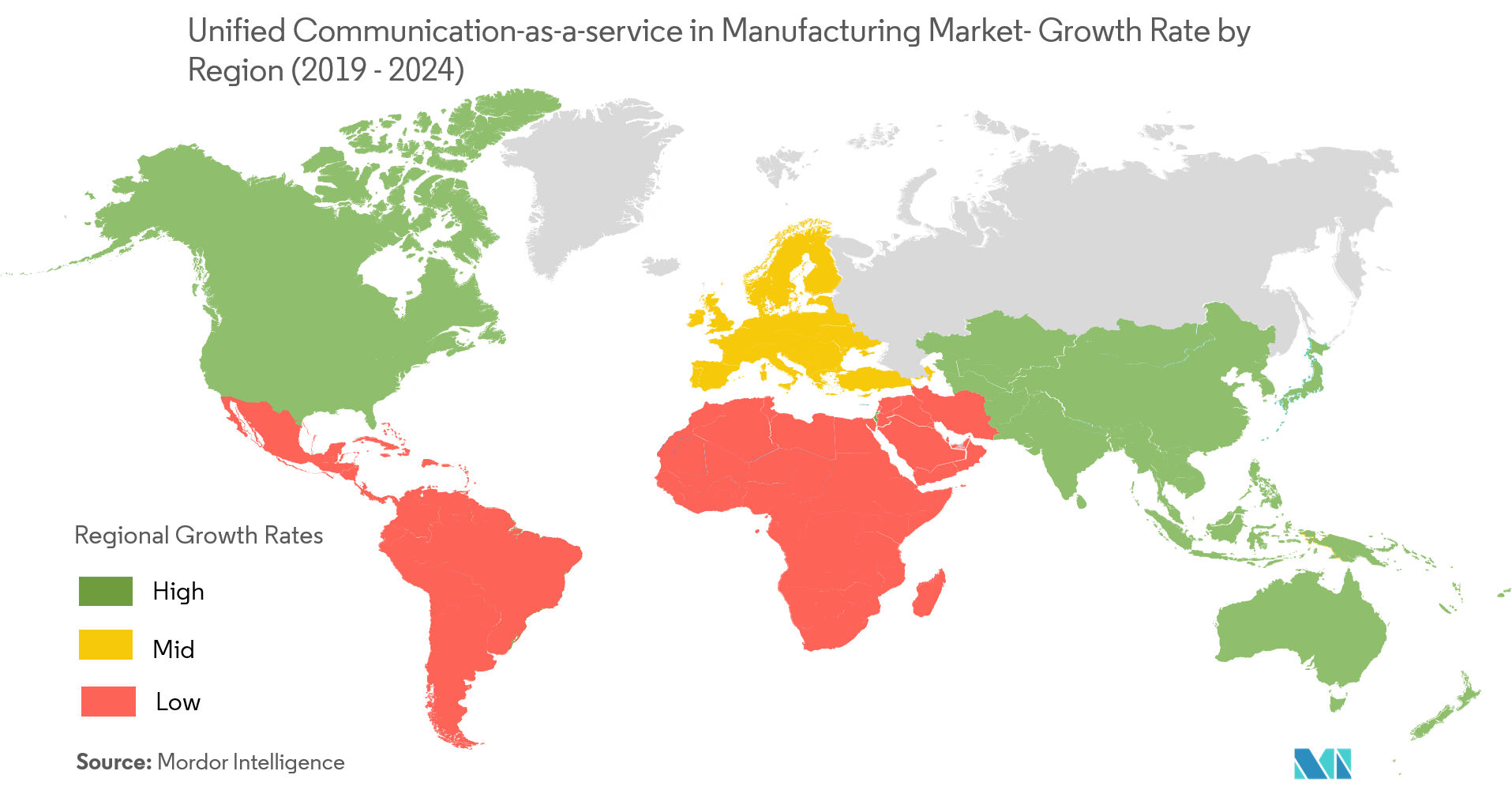

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

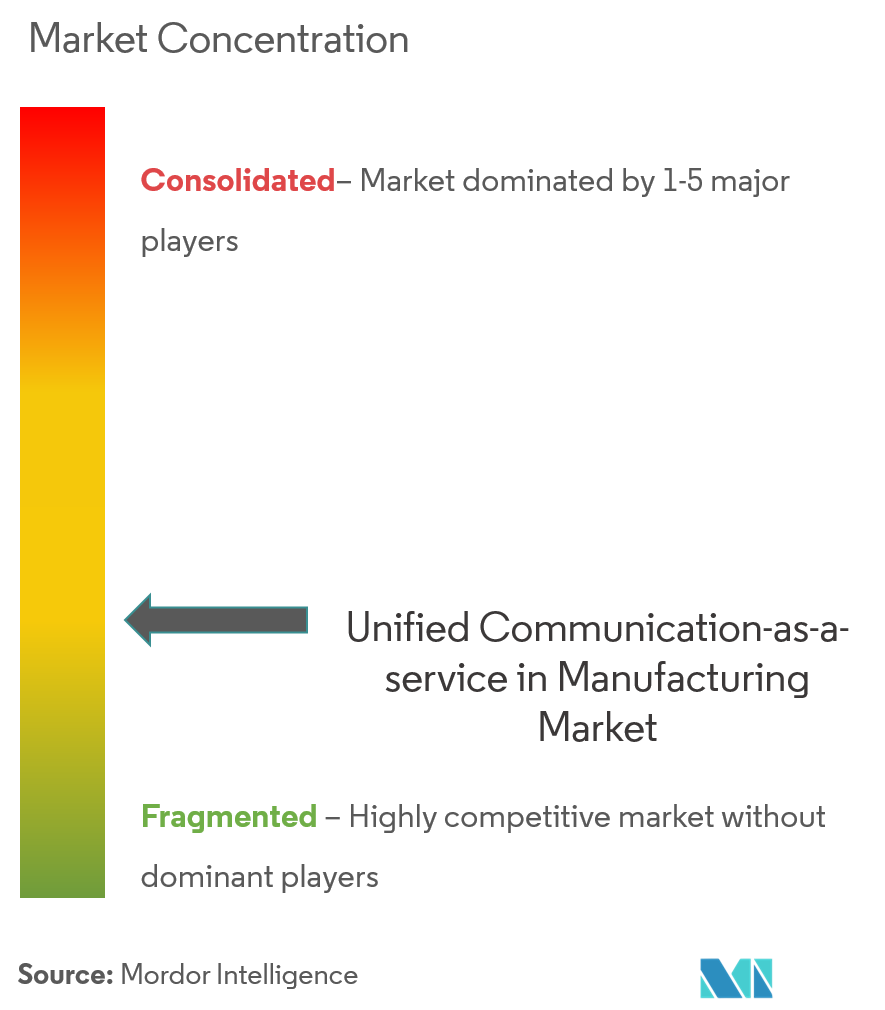

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

UCaaS Manufacturing Market Analysis

The unified communications-as-a-service in manufacturing market is expected to register a CAGR of 14.74% over the forecast period of (2021 - 2026). With the increasing adoption of Industry 4.0 initiatives by the manufacturing firms, are set to revamp the manufacturing industry which is also expected to influence the UCaaS market in a positive way.

- Modernizing outdated business phone and call center systems boost productivity and reduces costs according to industry estimations by 30%. Further, in the manufacturing industry, workers interact with different regional offices or headquarters to ensure smooth workflow. Thus, it will lead to the adoption of UCaaS in manufacturing.

- Moreover, as manufacturers are shifting to the cloud because of the features such as increased automation and agility, delivering enhanced customer experience, and increased cost savings and return on investment. Thus, owing to the benefits such as better communication, increased decision-making ability by the UCaaS solution will drive the market.

- in September 2019, Digerati Technologies, Inc. acquired Nexogy, Inc. a provider of cloud communication and broadband solutions tailored for businesses. The acquisition was a strategic move towards a continued focus on the US market of SMBs, of which approximately 75% or 21 million have not migrated to a UCaaS or cloud communications solution. Owing to such opportunities in the SMBs segment, it is expected to be the targeted market segment by vendors over the forecast period.

- However, the less awareness about UCaaS and their advantages are few restraints which are hampering the adoption rate of UCaaS.

UCaaS Manufacturing Market Trends

This section covers the major market trends shaping the UCaaS Manufacturing Market according to our research experts:

Increasing Government Initiative to Influence the Market

- According to Symphony RetailAI, 28% of retailers cited the growing dependence on parallel shippers to achieve faster fulfillment to consumers as challenges they face about their supply chain management. The adoption of UCaaS during such a process would lead to proper communication among them which would result in faster delivery of the products.

- In March 2019, Unified-communications-as-a-service provider Fuze has partnered with Samsung Electronics America Inc. to provide mobile UCaaS for remote and distributed workers. This partnership is expected to impact positively on the market.

- Moreover, factory-floor personnel is taking advantage of the BYOD policy by taking advantage of the convenience of mobile phones and tablet computers is driving the market. Implementing UCaaS will lead to integrating voice, text, and video on a single, mobile device, and one simple user interface would help in increasing productivity among the organizations.

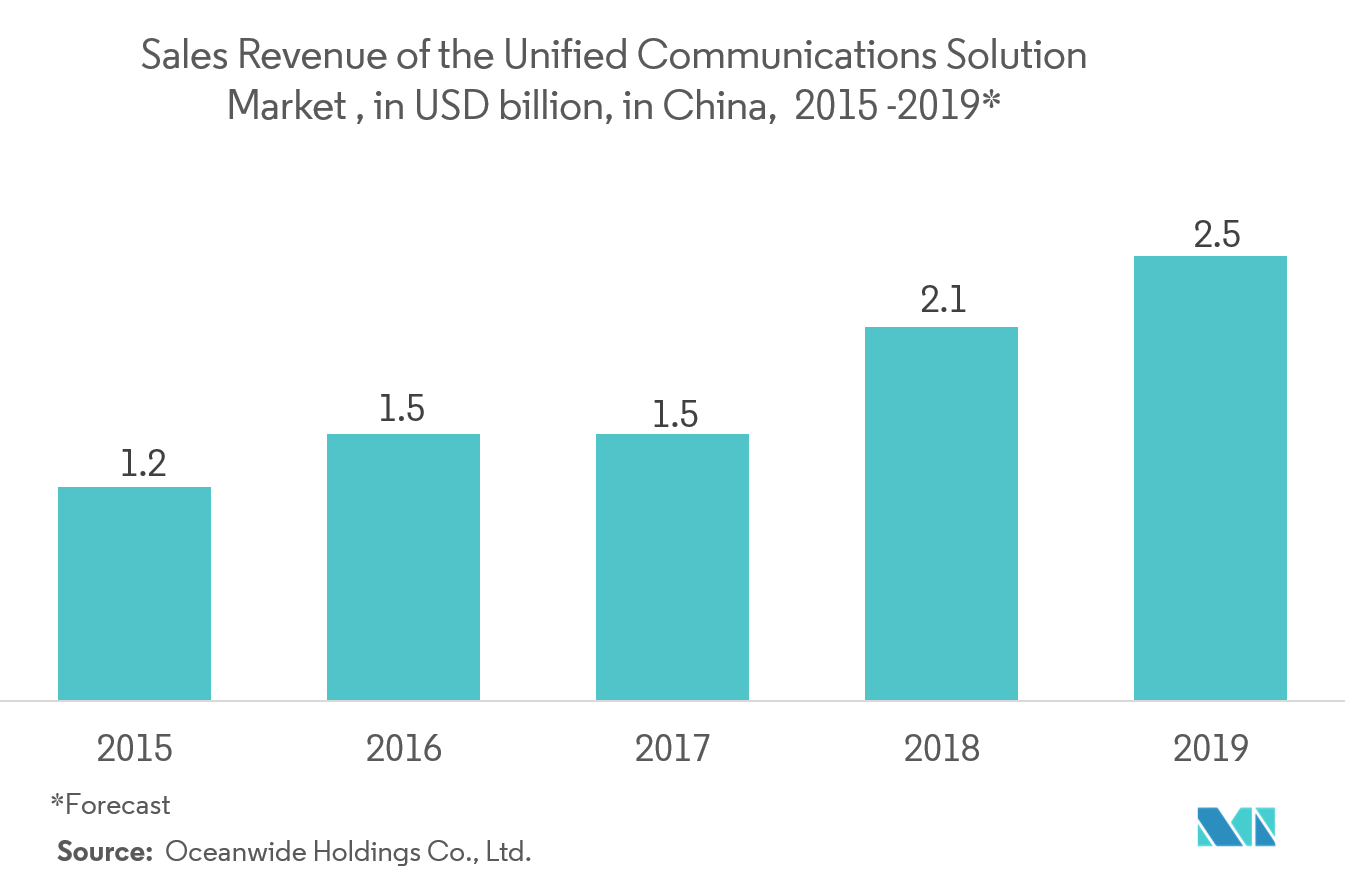

- Additionally, government initiatives such as Made in China 2025, which aim to make China dominant in the global high-tech manufacturing sector is influencing other regions which in return is driving the market. This initiative is focused on manufacturing electric cars and other new energy vehicles, next-generation information technology (IT) and telecommunications, and advanced robotics and artificial intelligence and are expected to drive the unified communication-as-a-service in the manufacturing market.

Asia- Pacific to Witness the Fastest Growth

- Asia-Pacific is expected to witness fastest growth owing to the presence of worlds's manufacturing hub i.e. China and other big economies such as India and Japan.

- Further, the introduction of new technologies like 5G is expected to drive the UCaaS market in the region. The increasing trial of launching 5G in different cities by China and Japan with a view to creating smart factories that would boost the UCaaS market positively.

- Moreover, the vendors are expanding their geographical presence in the region by implementing a strategic partnership or merger and acquisition is further driving the market.

- For instance, in July 2019, 8x8, Inc, announced the acquisition of privately-held Wavecell Pte. Ltd., a Singapore-based global Communications Platform-as-a-Service (CPaaS) provider. The acquisition expands 8x8’s presence into the rapidly growing Asian market, including Singapore, Indonesia, Philippines, Thailand, and Hong Kong.

- Additionally, Indian government initiative such as Make in India which is encouraging companies to manufacture their products in India and enthuse with dedicated investments into manufacturing is providing an opportunity for the market to grow exponentially.

- Therefore, all the factors are expected to complement the growth of the unified communication-as-a-service in manufacturing market in the region.

UCaaS Manufacturing Industry Overview

Theunified communications-as-a-service in the manufacturing market is highly competitive in nature because of the presence of global players. Some of the vendors are Cisco Systems, Inc,8x8, Inc,Avaya Inc., and Tata Communications.Product launches, high expense on research and development, partnerships and acquisitions, etc. are the prime growth strategies adopted by these companies to sustain the intense competition. Few recent developments are:

- September 2019 -8x8, Inc. launched an8x8 Video Meetings solutionsas part of their service subscriptions for Virtual Office mobile and desktop applications.8x8 Video Meetings enabledexternal participants to join meetings directly from their browser without the need to download plugins or software applications.

- September 2019 - Cisco Systems, Inc completed theacquisition of a privately-held Voicea.With the acquisition of Voicea technology, Cisco wouldenhance its Webex portfolio of products with a powerful transcription service that blends AI and Automated Speech Recognition (ASR) tounlock the power of any collaboration, like meetings and calls.

UCaaS Manufacturing Market Leaders

Cisco Systems, Inc

Tata Communications

Avaya Inc.

8x8, Inc.

Microsoft Corporation

*Disclaimer: Major Players sorted in no particular order

UCaaS Manufacturing Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Assumptions

-

1.2 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Market Drivers

-

4.2.1 Growing Trends Towards Mobility and BYOD

-

4.2.2 Integrated Supply Chain Management

-

-

4.3 Market Restraints

-

4.3.1 Lack of Awareness About the Unified Communication-as-a-service

-

-

4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

-

4.5.1 Threat of New Entrants

-

4.5.2 Bargaining Power of Buyers/Consumers

-

4.5.3 Bargaining Power of Suppliers

-

4.5.4 Threat of Substitute Products

-

4.5.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Business Size

-

5.1.1 Small and Midsize Business

-

5.1.2 Enterprise

-

-

5.2 By Deployment Model

-

5.2.1 On-Premises

-

5.2.2 Cloud

-

-

5.3 Geography

-

5.3.1 North America

-

5.3.1.1 United States

-

5.3.1.2 Canada

-

-

5.3.2 Europe

-

5.3.2.1 Germany

-

5.3.2.2 United Kingdom

-

5.3.2.3 France

-

5.3.2.4 Rest of Europe

-

-

5.3.3 Asia-Pacific

-

5.3.3.1 China

-

5.3.3.2 India

-

5.3.3.3 Japan

-

5.3.3.4 Rest of Asia-Pacific

-

-

5.3.4 Rest of World

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

-

6.1.1 88, Inc.

-

6.1.2 Avaya Inc.

-

6.1.3 Tata Communications

-

6.1.4 Cisco Systems, Inc.

-

6.1.5 Microsoft Corporation

-

6.1.6 Dimension Data

-

6.1.7 DXC Technology Company

-

6.1.8 Getronics

-

6.1.9 IBM Corporation

-

6.1.10 Mitel Networks Corporation

-

6.1.11 RingCentral, Inc

-

6.1.12 Verizon Wireless (Verizon Communications)

-

- *List Not Exhaustive

-

-

7. INVESTMENT ANANLYSIS

-

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

UCaaS Manufacturing Industry Segmentation

Implementation of UCaaS in the manufacturing industry brings various advantages, such as improved scalability, reliability, and collaboration among disparate workgroups. Manufacturing units typically consist of various diverse business units, which must be in collaboration with one another, further necessitating the use of UCaaS systems. Types of unified communications as a service package include messaging tools, videoconferencing tools, and resources for facilitating different kinds of text and voice communications. The scope of this market is limited to the regions such as North America, Europe, Asia-Pacific and Rest of World.

| By Business Size | |

| Small and Midsize Business | |

| Enterprise |

| By Deployment Model | |

| On-Premises | |

| Cloud |

| Geography | ||||||

| ||||||

| ||||||

| ||||||

| Rest of World |

UCaaS Manufacturing Market Research FAQs

What is the current UCaaS in the Manufacturing Market size?

The UCaaS in the Manufacturing Market is projected to register a CAGR of 17.74% during the forecast period (2024-2029)

Who are the key players in UCaaS in the Manufacturing Market?

Cisco Systems, Inc, Tata Communications, Avaya Inc., 8x8, Inc. and Microsoft Corporation are the major companies operating in the UCaaS in the Manufacturing Market.

Which is the fastest growing region in UCaaS in the Manufacturing Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in UCaaS in the Manufacturing Market?

In 2024, the North America accounts for the largest market share in UCaaS in the Manufacturing Market.

What years does this UCaaS in the Manufacturing Market cover?

The report covers the UCaaS in the Manufacturing Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the UCaaS in the Manufacturing Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

UCaaS in the Manufacturing Industry Report

Statistics for the 2024 UCaaS in the Manufacturing market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. UCaaS in the Manufacturing analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.