Bottled Water Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 336.21 Billion |

| Market Size (2029) | USD 452.90 Billion |

| CAGR (2024 - 2029) | 6.14 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Bottled Water Market Analysis

The Bottled Water Market size is estimated at USD 336.21 billion in 2024, and is expected to reach USD 452.90 billion by 2029, growing at a CAGR of 6.14% during the forecast period (2024-2029).

Extensive restrictive measures set up by governments around the world to combat the global coronavirus outbreak have been creating logistical challenges for the bottled water processing sector. There are number of initiatives taken by manufacturers to support the growth of the market even during the COVID-19 pandemic. For instance: In Sep 2020, global food and beverage company PepsiCo is announced to hand out 35,000 bottled water and canned soft drinks to UAE workers in partnership with social support volunteering organisation Draw a Smile

The demand for bottled water rose in the initial months of the lockdown stemmed from the stockpiling attitude of consumers in anticipation of lockdowns and scarcity. The trend, however, soon declined further, coupled with decreased sales caused due to setbacks of the tourism industry globally.

The demand for bottled water is driven by the fear of diseases as an aftermath of drinking contaminated tap water and the easy portability and convenience provided by bottled water. Environmental pollution caused by plastic trash poses a challenge for the market's growth. The consumption of bottled water leads to health hazards.

Bottled Water Market Trends

Growing Preference for Functional Water in North America

Functional water is vitamin-enriched waters that have gained consumer popularity for convenience, perceived health benefits, and improved flavor over tap water. There are increasing concerns regarding various health problems such as digestive issues, weight gain, heartburn, etc. due to which consumers are preferring a healthier option like functional water and flavored water.

Compared to other RTD beverages, functional waters are comparatively inexpensive and various packaging options, like containers and single-serve bottles, are making it more popular among consumers, thereby driving the growth of the functional water market. The rapid demand for fortified beverages is attributed to the inclusion of essential ingredients, such as protein, amino acids, vitamins, and minerals in various functional beverages. The introduction of new and innovative types of functional water from the beverage manufacturing companies that are engaged in the production of water from the modified blends of protein and minerals is likely to fuel the growth of the market.

North America Dominates the Market

In developed economies, like the United and Canada, functional water is constantly becoming a major commercial and popular beverage category, as it is an appealing option for health-conscious consumers. Hence, this is augmenting the bottled water market. Bottled water has remained the most profitable section of the beverage consumption market according to International Bottled Water Association (IBWA). Hence, this is augmenting the bottled water market. Major manufacturers and marketers in the country have started to position functional water as an alternative to carbonated drinks and fruit juices. Through product description, modern and interactive labeling and backing from respected brands and organizing programs and seminars, the players are claiming that functional water is an enriched product that is not just for hydration but also can function as a functional beverage.

Bottled Water Industry Overview

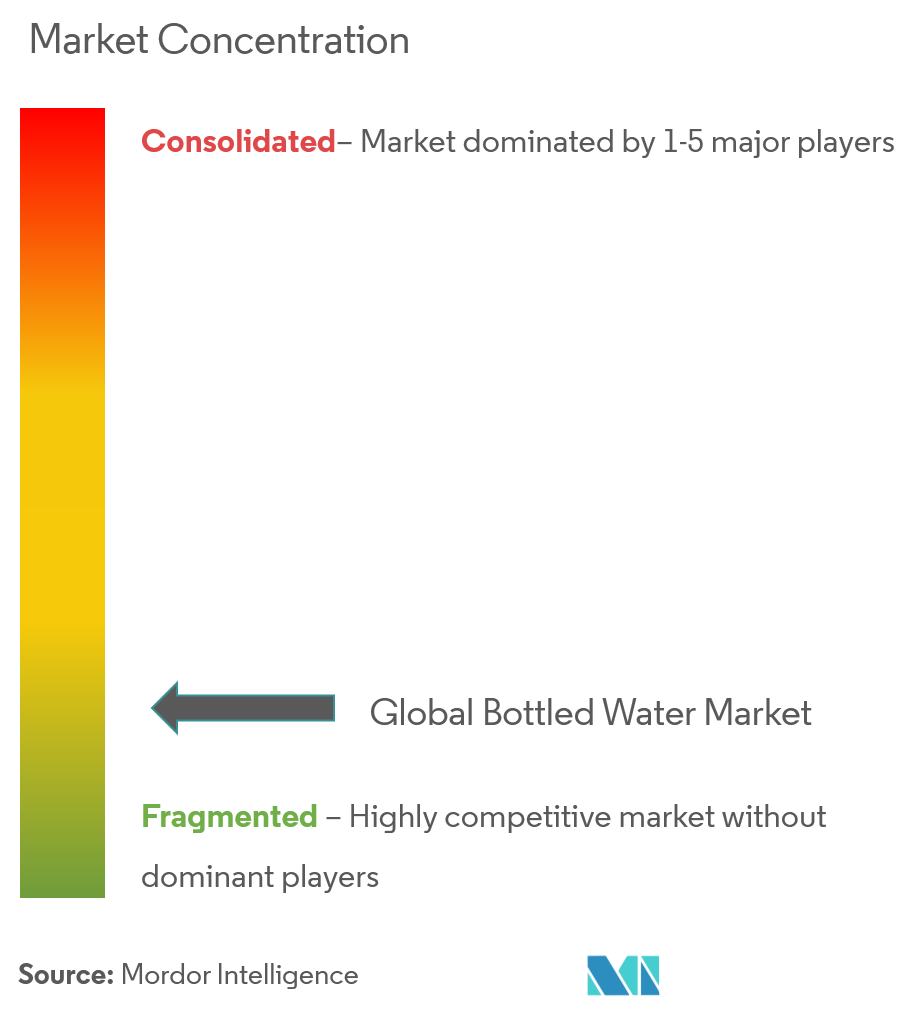

The bottled water market is highly competitive, attributed to the number of small players involved in the country and regional marketplace. Apart from convenience being the key factor, product innovation is a prominent move that the major players undertake to stay ahead in the market. Major players in the market are adopting a number of strategies, including mergers & acquisitions, collaborations, product launches, and expansion of products, on account of capturing the major market share and expanding their customer base across the globe. Product differentiation has gained significant traction over the past years. Regional or domestic companies have been marketing their products with strategies, such as sponsorship and significant investment in advertisements. Some of the globally renowned companies in the market include Danone SA, The Coca-Cola Company, Pepsico, and Nestle SA.

Bottled Water Market Leaders

Danone S.A.

PepsiCo Inc.

The Coca-Cola Company

Otsuka Pharmaceutical Co., Ltd.

Nestle SA

*Disclaimer: Major Players sorted in no particular order

Bottled Water Market News

- In April 2021, Nestle SA decided to sell its bottled water business in the United States and Canada to private equity company One Rock Capital Partners for USD 4.3 billion, being renamed BlueTriton Brands

- In October 2020, Primo Water Corporation announced the acquisition of Mountain Valley Water Company of Los Angeles, bringing the total number of customers to over 8,000.

- In February 2020, Agthia Group PJSC announced the launch of Al Ain Plant Bottle, the region's first plant-based water bottle. An MoU was also signed between Agthiaand Veolia, a global leader in optimized resource management, to launch a PET water bottle collection initiative in the United Arab Emirates.

Bottled Water Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 By Type

5.1.1 Still Water

5.1.2 Sparkling Water

5.1.3 Functional Water

5.2 By Distribution Channel

5.2.1 On-trade

5.2.2 Off-trade

5.2.2.1 Supermarkets/Hypermarkets

5.2.2.2 Convenience Stores

5.2.2.3 Home and Office Delivery

5.2.2.4 Online Retail Stores

5.2.2.5 Other Off-trade Channels

5.3 By Geography

5.3.1 North America

5.3.1.1 United States

5.3.1.2 Canada

5.3.1.3 Mexico

5.3.1.4 Rest of North America

5.3.2 Europe

5.3.2.1 Spain

5.3.2.2 United Kingdom

5.3.2.3 Germany

5.3.2.4 France

5.3.2.5 Italy

5.3.2.6 Russia

5.3.2.7 Rest of Europe

5.3.3 Asia-Pacific

5.3.3.1 China

5.3.3.2 Japan

5.3.3.3 India

5.3.3.4 Australia

5.3.3.5 Rest of Asia-Pacific

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle-East and Africa

5.3.5.1 South Africa

5.3.5.2 Saudi Arabia

5.3.5.3 Rest of Middle-East and Africa

6. COMPETITIVE LANDSCAPE

6.1 Most Active Companies

6.2 Most Adopted Strategies

6.3 Market Share Analysis

6.4 Company Profiles

6.4.1 Danone SA

6.4.2 The Coca-Cola Company

6.4.3 PepsiCo Inc.

6.4.4 Nestle SA

6.4.5 Otsuka Pharmaceutical Co. Ltd

6.4.6 FIJI Water Company LLC

6.4.7 Voss Water

6.4.8 National Beverage Corp.

6.4.9 Binzomah Group

6.4.10 Hana Water-Hana Food Industries Co.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. IMPACT OF COVID-19 ON THE MARKET

Bottled Water Industry Segmentation

Bottled water is packed drinking water that can be carbonated or not. The global bottled water market is segemnted by type, distribution channel, and geography. Based on type, the market is segmented into still water, sparkling water, and functional water. Based on distribution channel, the market is segmented into on-trade and off-trade distribution channels. The off-trade distribution channel is further sub-segmented into supermarkets/hypermarkets, convenience stores, home and office delivery (HOD), and other distribution channels. The study also covers a global level analysis for the major regions, namely, North America, Europe, Asia-Pacific, South America, and Middle-East and Africa. For each segment, the market sizing and forecasts have been done on the basis of value (in USD million).

| By Type | |

| Still Water | |

| Sparkling Water | |

| Functional Water |

| By Distribution Channel | |||||||

| On-trade | |||||||

|

| By Geography | |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

|

Bottled Water Market Research FAQs

How big is the Bottled Water Market?

The Bottled Water Market size is expected to reach USD 336.21 billion in 2024 and grow at a CAGR of 6.14% to reach USD 452.90 billion by 2029.

What is the current Bottled Water Market size?

In 2024, the Bottled Water Market size is expected to reach USD 336.21 billion.

Who are the key players in Bottled Water Market?

Danone S.A., PepsiCo Inc., The Coca-Cola Company, Otsuka Pharmaceutical Co., Ltd. and Nestle SA are the major companies operating in the Bottled Water Market.

Which is the fastest growing region in Bottled Water Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Bottled Water Market?

In 2024, the North America accounts for the largest market share in Bottled Water Market.

What years does this Bottled Water Market cover, and what was the market size in 2023?

In 2023, the Bottled Water Market size was estimated at USD 315.57 billion. The report covers the Bottled Water Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Bottled Water Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the key factors driving the Bottled Water Market?

The key factors driving the Bottled Water Market are a) Increasing focus on fitness and hydration further encourages bottled water consumption b) Concerns about tap water quality or access in some regions further drive consumption

Bottled Water Industry Report

The bottled water market is experiencing significant growth, propelled by heightened health awareness, concerns over waterborne diseases, and the scarcity of clean drinking water. With a diverse product range including still, sparkling, flavored, and functional water, the demand is leaning towards healthier alternatives to sugary beverages. PET bottles lead the packaging segment due to their cost-effectiveness, complemented by a shift towards eco-friendly solutions. Distribution is mainly through off-trade channels like supermarkets, with a notable preference for functional water in North America. The competitive landscape is marked by innovation in products, packaging, and marketing to cater to health-conscious consumers. For detailed insights into the Bottled Water market share, size, and forecast refer to Mordor Intelligence™ Industry Reports, available for download as a free report PDF.