Wireless Pressure Sensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 20.80 % |

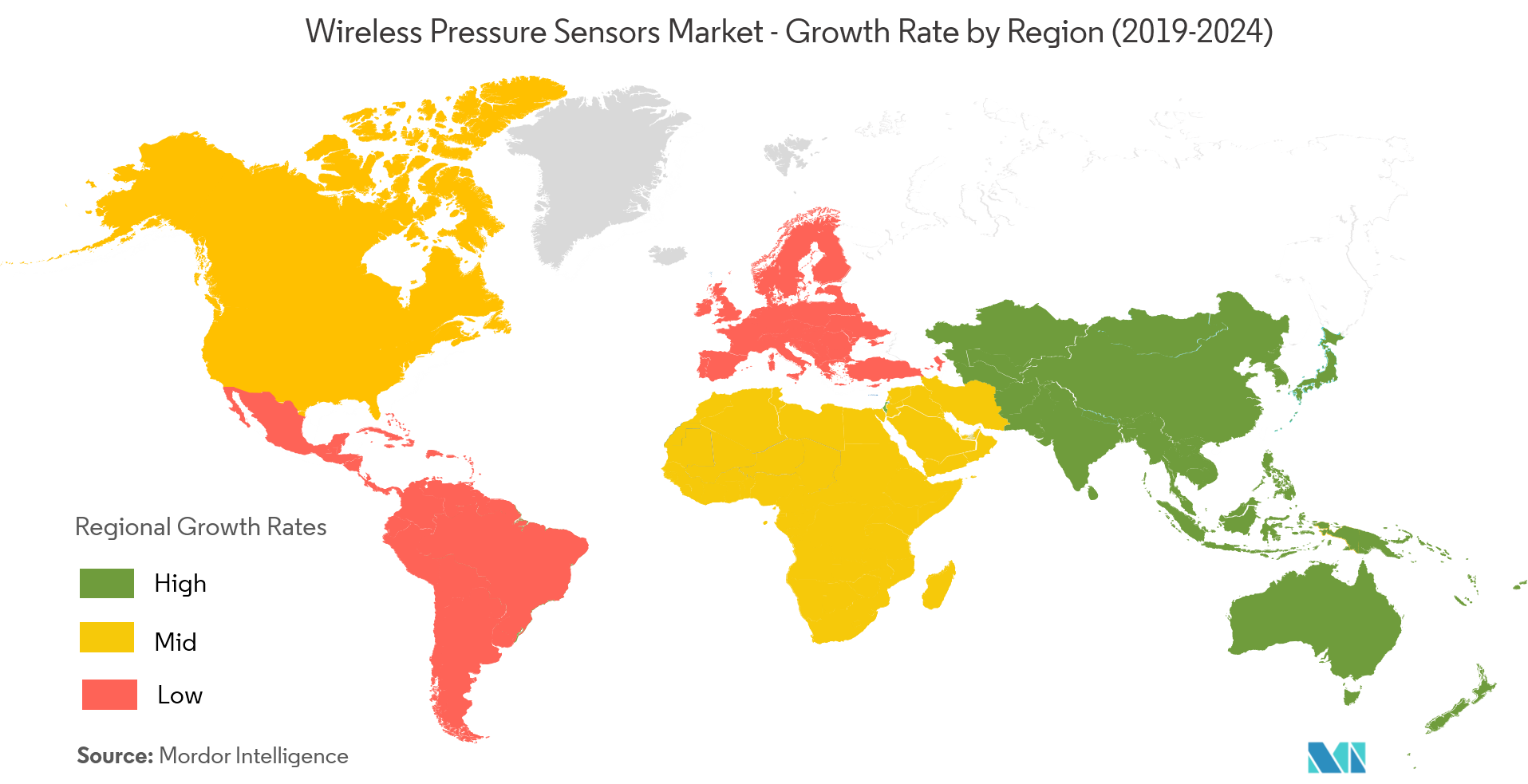

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

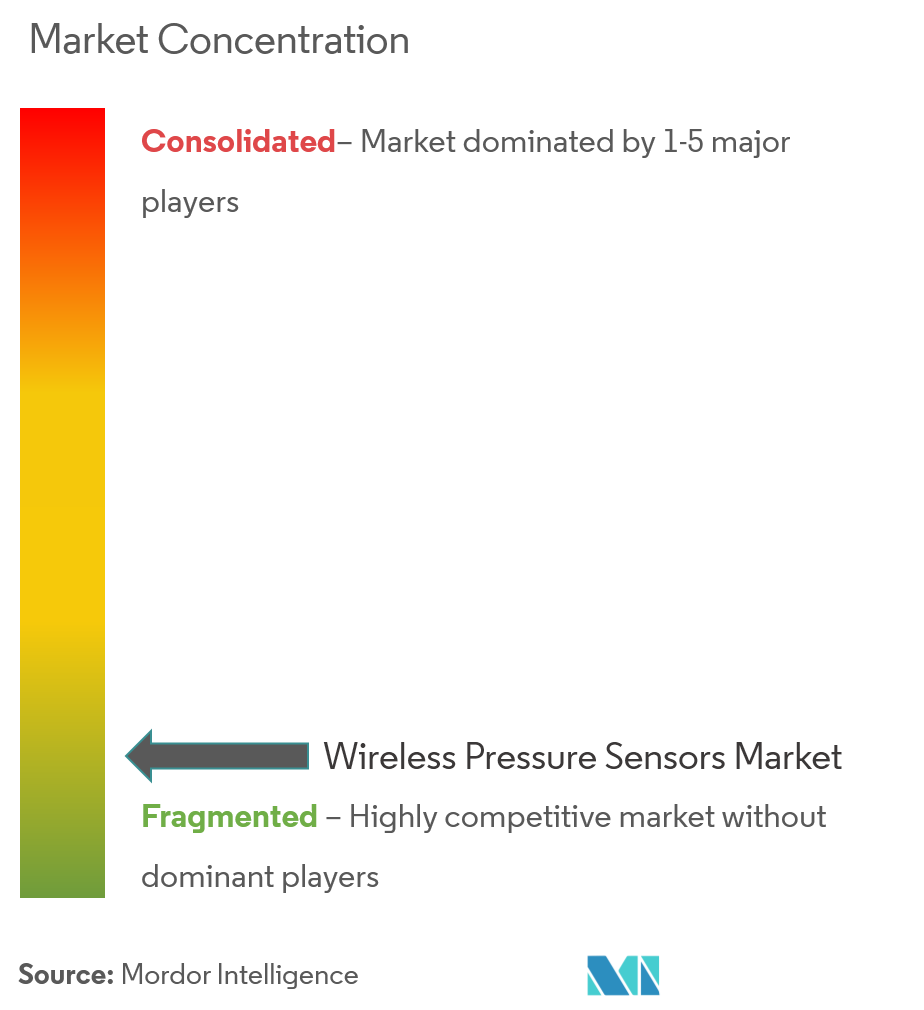

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Wireless Pressure Sensors Market Analysis

The Wireless Pressure Sensors market was valued at USD 691.9 million in 2020 and is expected to reach USD 2803.5 million by 2026, and grow at a CAGR of 20.8% over the forecast period (2021 - 2026), majorly driven by advancements in MEMS technology and its rapid adoption in connected devices, growing demand from automotive and medical device industries, increasing adoption of pressure sensors in consumer goods and wearables, and stringent government regulations. The wireless sensors market is a rapidly growing field as many sensor manufacturers are focusing on technological research and improvements in wireless sensing technology.

- The increasing adoption of wireless pressure sensors in consumer goods and wearable devices, such as watches, tablets, and smartphones, is substantially contributing to market expansion. The use of MEMS wireless pressure sensors in industrial control applications and processes, HVAC applications, and level measurement is instrumental in driving market growth. Government regulations or laws to ensure passenger safety in automobiles are also expected to be a major growth driver.

- Key challenges for wireless pressure sensors include a highly fragmented market, scarcity of open bandwidth, low reliability, hopping challenge, and the constantly evolving standards.

- However, the demand for high-performance, cost-efficient, and reliable sensors has increased, leading to higher spending in R&D activities by market vendors. These technological advancements in nanotechnology and micro-technology are expected to propel the market growth wireless pressure sensors over the forecast period.

Wireless Pressure Sensors Market Trends

This section covers the major market trends shaping the Wireless Pressure Sensors Market according to our research experts:

Wireless Pressure Sensors to Witness an Increased Demand from the Automotive Industry

- The automotive segment is anticipated to grow at a steady rate owing to progression in technology, the demand for concept cars, and automation, among others. The automotive industry has been an important end-user segment for legacy pressure sensors. High quality and absolute reliability are always on the preference list of automotive manufacturing.

- To achieve the optimum condition regarding performance and system cost, the pressure sensors have been a prime choice in many critical applications. However, with emerging applications, such as vehicle dynamics control, offline navigation, external airbag deployments, tire pressure monitoring, etc., the use of wireless pressure sensors is becoming increasingly popular in the automotive industry.

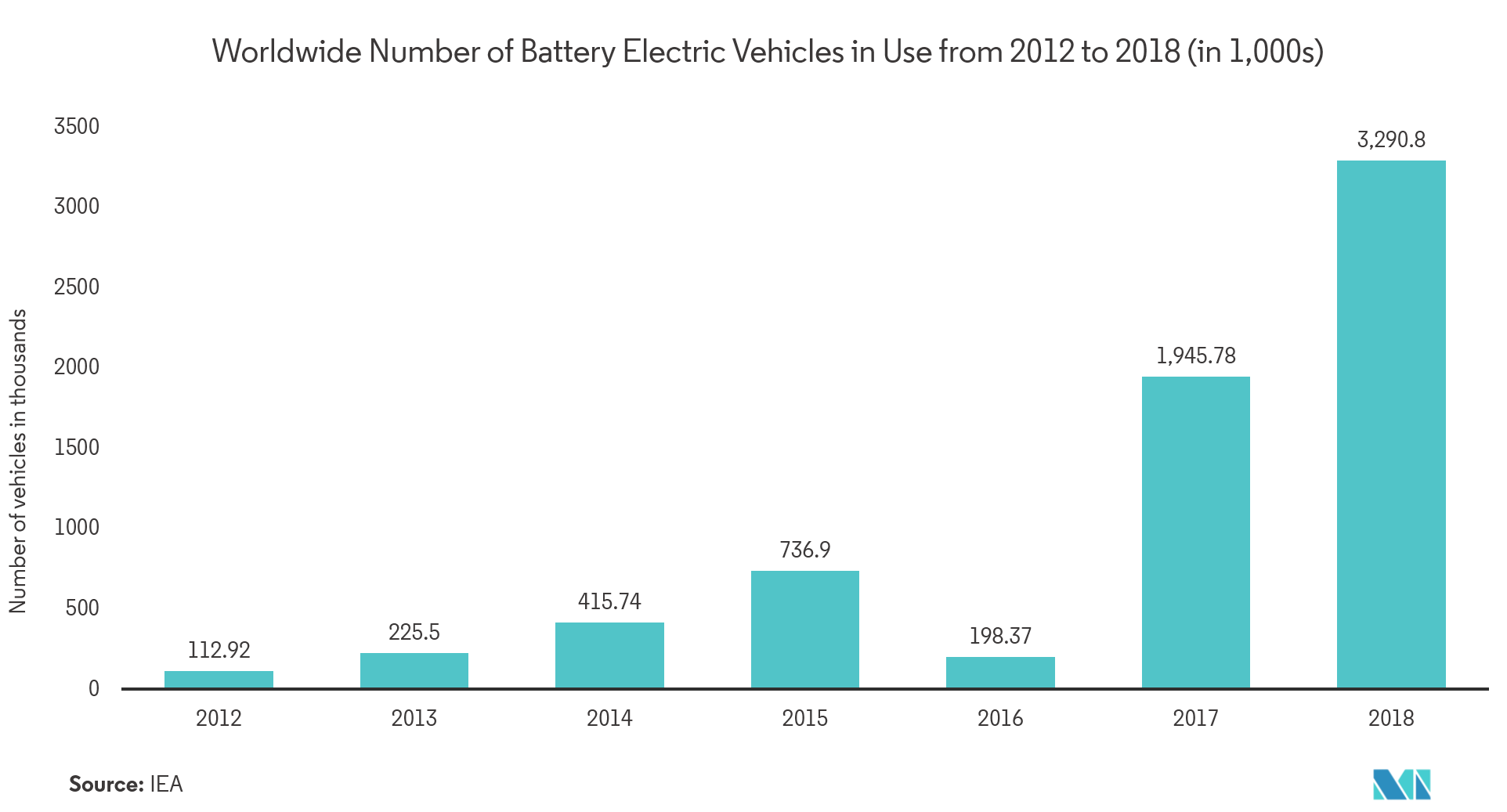

- With futuristic innovations, like electric cars and self-driving cars, the demand for these wireless pressure sensors is assumed to grow quickly from the automotive sector. Powertrain applications represent more than 50% of the business, followed by safety, with tire pressure management systems (TPMS) being the largest single automotive application. Driven by carbon dioxide emission reduction and automation, wireless pressure sensors will increasingly be adopted and used in the future.

North America to Hold a Dominant Share

- North America is expected to hold a strong share of the global wireless sensors market over the forecast period. The U.S. is a primary country in this region, due to the presence of companies like Rockwell Automation, Texas Instruments, etc. Technological proliferation and advancements in nanotechnology and micro-technology are expected to propel the market growth in North America over the forecast period.

- Moreover, the growing demand for wireless sensors in the defense sector is anticipated to fuel market growth. In 2019, the U.S. “Department of Defense” estimated a budget of USD 13.7 billion for investing in technological development. These investments are expected to increase considering the technological advancements, which will further boost the wireless sensors market in the future years.

- The wireless sensors market in North America is anticipated to make notable contributions to the global market for wireless sensors, due to the increasing product demand in the healthcare sector. Most of the healthcare organizations in North America are focusing on investing in the latest technologies to provide better healthcare services to the patients. The aim of using wireless sensors in healthcare is to ensure uninterrupted patient monitoring.

Wireless Pressure Sensors Industry Overview

The wireless pressure sensors market is highly competitive and consists of several major players. With a myriad of applications, the manufacturers are offered with increased potential owing to which they are adopting strategies such as collaborative initiatives, product innovations to increase their market share and increase their profitability. Therefore, the market concentration is low with players striving to expand their reach.

- February 2019 -Honeywellannounced the introduction of Aerospace’s hybrid-electric turbogenerator that will power the first generation of vertical takeoff and landing (VTOL) aircraft.The hybrid powerplant is an electrified version of its 1,100-shp HTS900 gas turbine engine used on Kopter’s SH09 light turbine helicopter andEagle Copters’ Eagle 407HP conversion.

- October 2018 -Murata developed the world’s smallest32.768 kHz MEMS resonator, which is expected to make a significant contribution to reducing the size and power consumption of IoT devices, wearables, and healthcare devices.

Wireless Pressure Sensors Market Leaders

ABB Group

Emerson Electric Company

Electro Scientific Industries, Inc.

Honeywell International, Inc.

Infineon Technologies AG

*Disclaimer: Major Players sorted in no particular order

Wireless Pressure Sensors Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

-

4.3.1 Growth in Automotive and Health Care Industries

-

4.3.2 Increasing Adoption of Wireless Systems Due to Industry 4.0

-

-

4.4 Market Restraints

-

4.4.1 High Cost Associated with Sensing Products

-

4.4.2 Low Product Differentiation

-

-

4.5 Technology Snapshot

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

-

4.6.1 Threat of New Entrants

-

4.6.2 Bargaining Power of Buyers/Consumers

-

4.6.3 Bargaining Power of Suppliers

-

4.6.4 Threat of Substitute Products

-

4.6.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Technology

-

5.1.1 Piezoresistive

-

5.1.2 CMOS

-

5.1.3 Capacitive

-

5.1.4 Optical Sensing

-

5.1.5 Piezoelectric

-

5.1.6 Other Technologies

-

-

5.2 By End-user Industry

-

5.2.1 Oil & Gas

-

5.2.2 Automotive

-

5.2.3 Healthcare

-

5.2.4 Consumer Electronics

-

5.2.5 IT and Telecom

-

5.2.6 Power & Energy

-

5.2.7 Entertainment & Media

-

5.2.8 Other End-user Industries

-

-

5.3 Geography

-

5.3.1 North America

-

5.3.1.1 United States

-

5.3.1.2 Canada

-

-

5.3.2 Europe

-

5.3.2.1 Germany

-

5.3.2.2 United Kingdom

-

5.3.2.3 France

-

5.3.2.4 Rest of Europe

-

-

5.3.3 Asia Pacific

-

5.3.3.1 China

-

5.3.3.2 Japan

-

5.3.3.3 India

-

5.3.3.4 Rest of Asia-Pacific

-

-

5.3.4 Rest of the World

-

5.3.4.1 Latin America

-

5.3.4.2 Middle East & Africa

-

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

-

6.1.1 ABB Group

-

6.1.2 Emerson Electric Company

-

6.1.3 ESI, Inc.

-

6.1.4 Honeywell International, Inc.

-

6.1.5 Infineon Technologies AG

-

6.1.6 OleumTech Corporation

-

6.1.7 Phoenix Sensors LLC

-

6.1.8 Siemens AG

-

6.1.9 TE Connectivity Ltd

-

6.1.10 Texas Instruments, Inc.

-

6.1.11 Acuity Incorporated

-

6.1.12 Analog Devices, Inc.

-

6.1.13 Rockwell Automation, Inc.

-

6.1.14 Murata Manufacturing Co., Ltd.

-

- *List Not Exhaustive

-

-

7. INVESTMENT ANALYSIS

-

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

Wireless Pressure Sensors Industry Segmentation

A wireless pressure sensor is a device that measures the changes in the physical quantity or environmental characteristics of any material and converts them into signals, which, in turn, serve as inputs for controlling the device. These sensors are self-contained, battery-powered monitoring solutions that are useful for many industrial applications including wellhead pressure and casing pressure monitoring. It typically measures the pressure of a variety of gases and liquids and usually acts as a transducer that generates an electric signal due to applied pressure.

| By Technology | |

| Piezoresistive | |

| CMOS | |

| Capacitive | |

| Optical Sensing | |

| Piezoelectric | |

| Other Technologies |

| By End-user Industry | |

| Oil & Gas | |

| Automotive | |

| Healthcare | |

| Consumer Electronics | |

| IT and Telecom | |

| Power & Energy | |

| Entertainment & Media | |

| Other End-user Industries |

| Geography | ||||||

| ||||||

| ||||||

| ||||||

|

Wireless Pressure Sensors Market Research FAQs

What is the current Wireless Pressure Sensors Market size?

The Wireless Pressure Sensors Market is projected to register a CAGR of 20.80% during the forecast period (2024-2029)

Who are the key players in Wireless Pressure Sensors Market?

ABB Group, Emerson Electric Company, Electro Scientific Industries, Inc., Honeywell International, Inc. and Infineon Technologies AG are the major companies operating in the Wireless Pressure Sensors Market.

Which is the fastest growing region in Wireless Pressure Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Wireless Pressure Sensors Market?

In 2024, the North America accounts for the largest market share in Wireless Pressure Sensors Market.

What years does this Wireless Pressure Sensors Market cover?

The report covers the Wireless Pressure Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Wireless Pressure Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Wireless Pressure Sensors Industry Report

Statistics for the 2024 Wireless Pressure Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Wireless Pressure Sensors analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.