Africa Textile Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2020 - 2022 |

| CAGR | > 4.00 % |

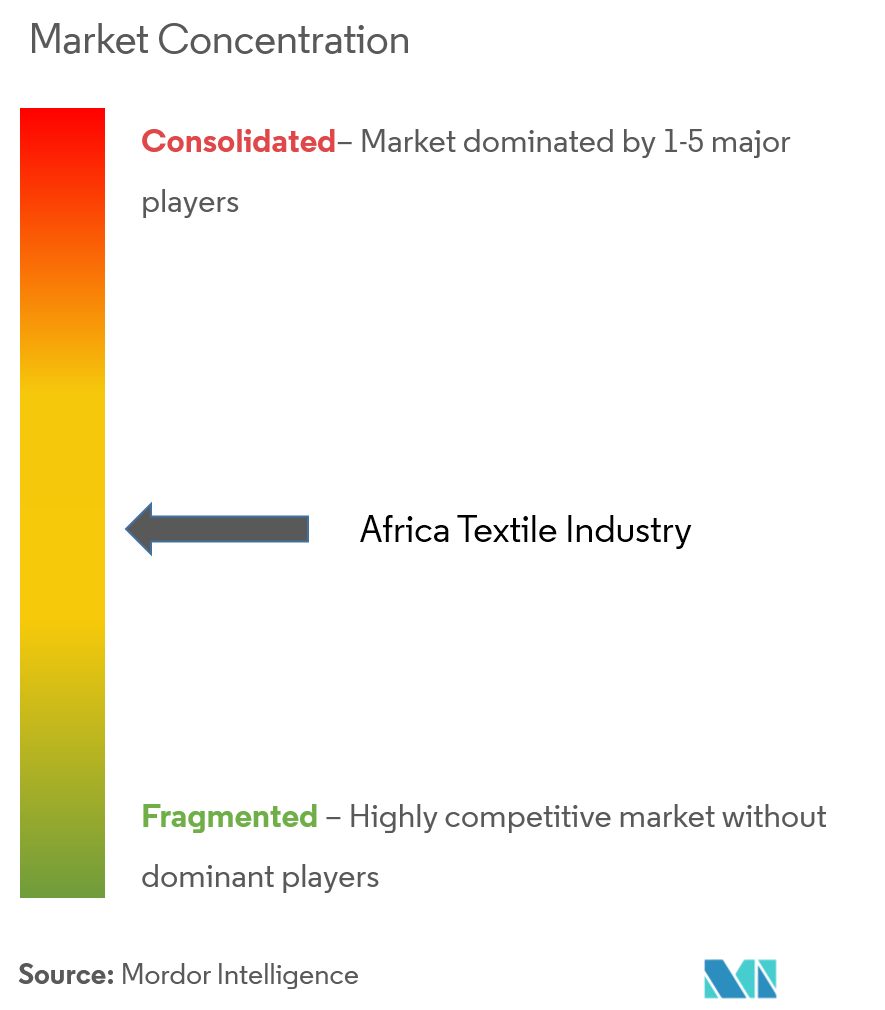

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Africa Textile Market Analysis

The African textile industry is a varied one, but the seeming constant is their cotton market. There are many countries in Africa that currently grow and sell cotton. Six of them grow cotton under the label ''Cotton made by Africa'', which is one of the largest job producers as well, with 450,000 Africans working in the cotton business alone. The growing and selling of cotton is not their only textile industry though. South Africa has also gotten into technical textiles as well, by providing hemp to aeronautics companies for their products. Countries like Ethiopia are also starting to gain textile mills which employ locals and help businesses trying to escape the rising wages in countries like China. Companies like H&M have opened mills in Africa, since their wages are less, and the population can support the workers needed. They also create products like thread and yarn for global markets from cotton is grown and harvested in Africa.

The disruption of the COVID-19 pandemic on global value chains and its impact on African businesses is already evident. The pandemic and global economic lockdowns have had an immediate effect on textile production, sales, and trade. There has been a significant expansion in ecommerce and online shopping because of the lockdown. Clothing is a major and rapidly growing product category for ecommerce, but textiles are a rather niche online segment.

Africa Textile Market Trends

This section covers the major market trends shaping the Africa Textile Market according to our research experts:

Impact of AGOA on the African Textile Industry

To boost the economic power of the African continent, the U.S. congress signed the African Growth and Opportunity Act (AGOA) through the US Trade and Development Act of 2000 into law on May 18 2000, and since its enactment, continuous tangible results and tremendous success have been achieved till the present by the eligible members such as Kenya, Malawi, Lesotho, Equatorial Guinea, Gabon, Zimbabwe and Gambia among others.

Through AGOA, US opened up its market for African products, textiles taking the lion's share where it offers sub-Saharan exporters of apparel to the U.S. market a duty-free access which is a great leverage over non-eligible members such as Asian countries thus, reducing cost of production which gives the U.S market a better option for African textile products such as infants wear, grey fabrics, spun cotton yarn, wool, ginned cotton etc. These products have the most potential for competitive production in Sub-Saharan African countries either for direct export, or for use in downstream production of apparel for export to the United States than other continental market like Asia, and Europe among others.

Textile producers and exporters across Africa rely majorly on the impact of new trade rules that took effect in January 2005. The rules, negotiated at the World Trade Organization (WTO), opened up to market forces a sector that had been protected for more than 30 years by ending a quota system in industrial nations which resulted in a ready market for textiles and apparel from African and other developing countries.

Also, the demand for African textiles and garments is increasing globally, and African patterns are gaining recognition as truly fashionable and iconic pieces. International fashion houses are integrating more and more African influences in their latest collections.

Rising Investment in Ethiopia

Major Chinese textile companies are stepping up sourcing and investment plans in Ethiopia following a visit to the African country by a delegation of industry representatives organized by the International Trade Centre.

Over the last twenty years, China has become an increasingly important source of financing in African economies, including in Ethiopia's young but fast-growing manufacturing sector.

In 2018, China Chamber of Commerce for Textiles (CCCT) have sourcing agreements and explored investment partnerships with Ethiopia-based partners of local textile companies and leaders of Ethiopian Textile and Garment Industry Association as well as with high-level government officials.

The Chinese delegates were impressed by Ethiopia's progress on improving infrastructure, including roads, trains, and electricity, though they suggested that further enhancing labour productivity and lowering logistics costs would make the country an even more attractive destination for investment.

The current trade tensions between the United States and Beijing were cited as an additional incentive for Chinese firms to invest in Ethiopia, with increasing difficulties associated with exporting from China.

Africa Textile Industry Overview

The report covers major international players operating in the Africa Textile Industry. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Africa Textile Market Leaders

CIEL Textile Ltd.

Almeda Textile Factory Plc

Edcon

Truworths

Gelvenor Textiles

*Disclaimer: Major Players sorted in no particular order

Africa Textile Market News

- Feb 2021 - Truworths is launching a new value fashion chain called Primark. Truworths plans to open approximately 15 Primark stores over the next few months, with an average store size of 100m² during the launch trial phase. These will be a mix of standalone stores and others located in existing Truworths-owned stores. The launch of Primark suggests that Truworths which also owns Identity, YDE, Uzzi and Earthchild hopes to tap into the growth opportunities present in the budget clothing market focused on lower-income consumers.

Africa Textile Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints

4.4 Value Chain / Supply Chain Analysis

4.5 Porters Five Force Analysis

4.5.1 Threat of New Entrants

4.5.2 Bargaining Power of Buyers/Consumers

4.5.3 Bargaining Power of Suppliers

4.5.4 Threat of Substitute Products

4.5.5 Intensity of Competitive Rivalry

4.6 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

5.1 Application

5.1.1 Clothing

5.1.2 Industrial/Technical Applications

5.1.3 Household Applications

5.2 Material Type

5.2.1 Cotton

5.2.2 Jute

5.2.3 Silk

5.2.4 Synthetics

5.2.5 Wool

5.3 Process

5.3.1 Woven

5.3.2 Non-woven

6. COMPETITIVE LANDSCAPE

6.1 Market Concentration Overview

6.2 Company Profiles

6.2.1 CIEL Textile Ltd.

6.2.2 Almeda Textile Factory Plc

6.2.3 Edcon

6.2.4 Truworths

6.2.5 Woolworths

6.2.6 Gelvenor Textiles

6.2.7 Mediterranean Textile Company S.A.E

6.2.8 Saygin-Dima Textile Sc

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. DISCLAIMER

Africa Textile Industry Segmentation

A complete background analysis of the Africa Textile Industry, which includes an assessment of the parental market, emerging trends by segments and regional markets, significant changes in market dynamics, and market overview, is covered in the report. The Market is Segmented By Application Type (Clothing, Industrial/Technical Applications, and Household Applications), By Material Type (Cotton, Jute, Silk, Synthetics, and Wool), and By Process Type (Woven and Non-woven). The report offers Market Size and forecasts for Africa Textile Market in Value (USD Billion) for all the above segments.

| Application | |

| Clothing | |

| Industrial/Technical Applications | |

| Household Applications |

| Material Type | |

| Cotton | |

| Jute | |

| Silk | |

| Synthetics | |

| Wool |

| Process | |

| Woven | |

| Non-woven |

Africa Textile Market Research FAQs

What is the current Africa Textile Market size?

The Africa Textile Market is projected to register a CAGR of greater than 4% during the forecast period (2024-2029)

Who are the key players in Africa Textile Market?

CIEL Textile Ltd., Almeda Textile Factory Plc, Edcon, Truworths and Gelvenor Textiles are the major companies operating in the Africa Textile Market.

What years does this Africa Textile Market cover?

The report covers the Africa Textile Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Africa Textile Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Textile in Africa Industry Report

Statistics for the 2024 Textile in Africa market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Textile in Africa analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.