Accounting Software Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 19.74 Billion |

| Market Size (2029) | USD 30.66 Billion |

| CAGR (2024 - 2029) | 9.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Accounting Software Market Analysis

The Accounting Software Market size is estimated at USD 19.74 billion in 2024, and is expected to reach USD 30.66 billion by 2029, growing at a CAGR of 9.20% during the forecast period (2024-2029).

Over the past two decades, the financial and accounting software solution market has witnessed numerous changes. One of the most significant changes is the cloud-based offering of accounting software solutions.

- The accounting software solutions streamline the accounting process, save time, and ensure an error-free transaction between the companies and clients. These systems are designed to increase productivity by archiving, automating, and integrating human resource systems. Implementing accounting software across SMEs helps reduce errors from dealings with clients and companies, thereby improving relationships and reputations while ensuring time to focus on the core business idea.

- The increasing trend of small and medium enterprises collaborating with e-commerce players and integrating with other online applications, such as automated bank feeds and automated billing features, is expected to further drive the adoption of accounting software during the forecast period. It helps increase efficiency, keeping track of all the accounting transactions and managing the money flowing in and out of business. The software has also become a better solution for managing a company's accounts. It can easily manage account payables, account receivables, business payroll, general ledger, and other business modules.

- The market has seen a significant share of vendors with accounting at the core, leveraging the cloud's cost benefits. Additionally, they have been targeting the ever niche "micro and small and medium" businesses. One of the notable strategies exhibited by these new accounting software entrants is the inclusion of advanced features, such as artificial intelligence, for applications, such as planning, learning, problem-solving, and speech recognition.

- For instance, an Australia-based tax, accounting, and other business services software provider's solution, MYOB Advisor, gives natural descriptions of a business's financial position. Accountants and bookkeepers can customize the report based on their SME client's knowledge and experience. Moreover, the insights provided by MYOB Advisor include visualization of cash flow that enables the advisor to help their client see where their cash is going or give a view of top customers and help clients better manage their high-value relationships.

- Also, many companies are extending their partnership programs to increase their market share. Hence, in March 2022, GTreasury has announced a partnership with Infor. Built on the Azure platform, GTreasury will provide Infor customers with a comprehensive Treasury solution that includes cash management, payments, debt and investment management, risk and exposure management, hedge accounting, and reporting functionality that includes dashboards. The acquisition will combine the data from Infor with GTreasury features, enabling Infor customers to handle cash management better.

- Moreover, as multiple countries worldwide have faced the challenge of dealing with the coronavirus outbreak and lockdown, more businesses, tiny businesses, have been working remotely. This has increased the demand for more dynamic and remote access to the business financial records and systems by the individuals who need to work on them and those who must access this timely information accurately to make decisions to manage the financial affairs.

Accounting Software Market Trends

Increased Efficiency Offered by Accounting Software to Drive the Market Growth

- Accounting software increases efficiency as it is used to keep track of accounting transactions or to manage the money flowing in and out of business. It has emerged as a better solution for managing a company's accounts, as it can easily manage account payables, account receivables, business payroll, general ledger, and other business modules.

- Additionally, features that ensure the company's accurate financials, such as time-saving, cost-effective operation, and higher overall productivity, are expected to drive the demand. Besides, these factors make this software more deployable for small businesses.

- Businesses purchase accounting-based software to increase their functionality and replace the dated system. The reason being, in accounting calculation, is tedious and complex. It will require the workforce to complete things. But accounting software can do the analysis precisely and accurately without a workforce.

- Moreover, automation in the accounting industry is also an ongoing trend driven by software advancement. Accounting has been made highly automated without the need for significant physical intervention. The latest accounting software has enabled organizations to minimize their human resources. This has led to efficient capital utilization and better available resources management.

Asia-Pacific to Witness the Highest Growth

- The Asia-Pacific is expected to grow faster for accounting software, primarily due to the increasing penetration of business accounting mobile applications and higher adoption of cloud computing technologies and solutions across the region. Moreover, the emergence of small businesses and rising investments by SMEs in the cloud and the SaaS market will likely boost the market's growth.

- By implementing various initiatives to build more business confidence in the cloud, the local governments play a significant role in developing the cloud integration services market across the region, creating more opportunities for the studied market.

- Also, the government's growing focus in the region to ease organizational payments and transactions and generate a track of debt, liabilities, and assets increases the demand for the market studied.

- Moreover, countries in the region are adopting automation is promoting the development and use of new technologies, which has increased the demand for accounting software to help businesses optimize their operations. Countries like China, Japan, India are witnessing advancement in industrial-grade digital technology, A high preference for cloud-based accounting software, as well as an increase in demand for improved financial management and tax planning methods, all contribute to the market's expansion. Additionally, businesses are accelerating the adoption of accounting software in various industries as they move towards digitalization and Industry 4.0 in order to meet their needs. This is due to the need to deal with the ongoing, fierce competition in the business world.

Accounting Software Industry Overview

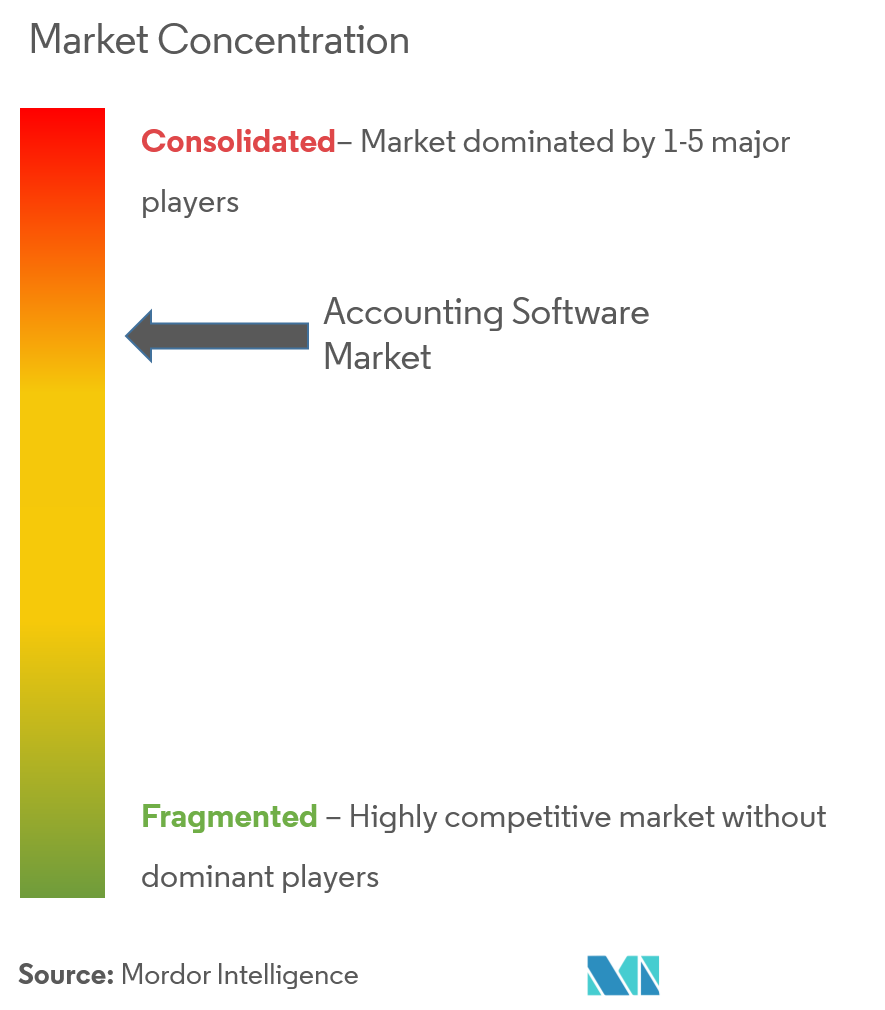

The accounting software market is moderately consolidated. The top players occupy a significant share of the market. Moreover, existing players already have their client base, which doesn't want to switch to new players, and new players cannot sustain the market for a more extended period as they get acquired by the top players in the long run. Some key players include Oracle Corporation, Microsoft Corporation, Intuit Inc., SAP SE, Sage Software Inc., Infor Inc., Epicor Software Corporation, Xero Ltd., and Unit4 Business Software Limited.

- March 2023 - Focus Softnet announced the launch of its new accounting software i.e FocusLyte which is a cloud-based system that assists in handling company's invoices and payments. The software is mainly designed for medium and small enterprises.

- January 2023 - ezAccounting software from Halfpricesoft.com has been updated. The company has updated its software and made it available for the customers at no additional cost. The software will allow customers to process payroll and business tasks all in one easy and affordable software application.

Accounting Software Market Leaders

Oracle Corporation

Microsoft Corporation

SAP SE

Xero Ltd

Intuit Inc.

*Disclaimer: Major Players sorted in no particular order

Accounting Software Market News

- July 2022 - Xero unveils Xero Go, a new app to help sole traders access entry-level accounting that will support the self-employed to get ready for one of the most significant changes to the UK tax system - Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) and Record expenses on the fly using the Quickscan feature, powered by machine learning and auto-suggests tax categories for them, saving time on manual expense record gathering and tax coding around submission dates and supports better accuracy.

- August 2022 Intuit Accountants Launches Intuit Tax Advisor Integrating Tax Prep and Advisory, a new, convenient insights tool for tax professionals to deliver tax advisory services. Intuit Tax Advisor seamlessly integrates with Intuit Accountant software, Lacerte, and ProConnect Tax, to provide insights and strategies for the tax professional's clients. ITA helps in all recommended tax strategies and estimated tax savings automatically populated in a personalized, client-friendly report for tax professionals to share with their clients, and can be customized with specific firm logos and colors.

Accounting Software Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

4.1 Market Overview

4.2 Industry Value Chain Analysis

4.3 Industry Attractiveness - Porter's Five Force Analysis

4.3.1 Bargaining Power of Suppliers

4.3.2 Bargaining Power of Consumers

4.3.3 Threat of New Entrants

4.3.4 Intensity of Competitive Rivalry

4.3.5 Threat of Substitute Products

4.4 Technology Snapshot

4.5 Assessment of COVID-19 Impact on the Market

5. MARKET DYNAMICS

5.1 Market Drivers

5.1.1 Increasing Trend of Accounting Automation

5.2 Market Restraints

5.2.1 Lack of Awareness

6. MARKET SEGMENTATION

6.1 By Deployment Type

6.1.1 On-premise

6.1.2 Cloud-based

6.2 Organization Size

6.2.1 Small and Medium Enterprises

6.2.2 Large Enterprises

6.3 Geography

6.3.1 North America

6.3.2 Europe

6.3.3 Asia Pacific

6.3.4 Latin America

6.3.5 Middle East and Africa

7. COMPETITIVE LANDSCAPE

7.1 Company Profiles

7.1.1 Intuit Inc.

7.1.2 Sage Software Inc.

7.1.3 SAP SE

7.1.4 Oracle Corporation

7.1.5 Microsoft Corporation

7.1.6 Infor Inc.

7.1.7 Epicor Software Corporation

7.1.8 Unit4 Business Software Limited

7.1.9 Xero Ltd

7.1.10 Zoho Corp

7.1.11 Red Wing Software Inc.

7.1.12 MYOB Group Pty Ltd

7.1.13 Reckon Ltd.

7.1.14 Saasu Pty Ltd

- *List Not Exhaustive

8. VENDOR MARKET SHARE ANALYSIS

9. INVESTMENT ANALYSIS

10. FUTURE OF THE MARKET

Accounting Software Industry Segmentation

Accounting software processes and records accounting transactions within functional modules such as accounts payable, accounts receivable, payroll, and trial balance. It mainly functions as an accounting information system. Moreover, the accounting software also keeps track of cash flows and transactions, performs calculations, and generates reports. Eventually, accounting software may help improve profitability, efficiency, and operations and reduces costs.

The Accounting Software Market is segmented by Deployment Type (On-premises, Cloud-based), Organization Size (Small and Medium Enterprises, Large Enterprises), and Geography (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa).

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| By Deployment Type | |

| On-premise | |

| Cloud-based |

| Organization Size | |

| Small and Medium Enterprises | |

| Large Enterprises |

| Geography | |

| North America | |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Accounting Software Market Research FAQs

How big is the Accounting Software Market?

The Accounting Software Market size is expected to reach USD 19.74 billion in 2024 and grow at a CAGR of 9.20% to reach USD 30.66 billion by 2029.

What is the current Accounting Software Market size?

In 2024, the Accounting Software Market size is expected to reach USD 19.74 billion.

Who are the key players in Accounting Software Market?

Oracle Corporation, Microsoft Corporation, SAP SE, Xero Ltd and Intuit Inc. are the major companies operating in the Accounting Software Market.

Which is the fastest growing region in Accounting Software Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Accounting Software Market?

In 2024, the North America accounts for the largest market share in Accounting Software Market.

What years does this Accounting Software Market cover, and what was the market size in 2023?

In 2023, the Accounting Software Market size was estimated at USD 18.08 billion. The report covers the Accounting Software Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Accounting Software Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Accounting Software Industry Report

The market for business accounting software has undergone substantial transformations over the past two decades, with cloud-based solutions gaining increasing traction. These financial management software solutions simplify the accounting process, saving time and ensuring error-free transactions between businesses and clients. They also boost productivity by archiving, automating, and integrating human resource systems. The trend of small and medium enterprises partnering with e-commerce entities and integrating with other online applications is anticipated to further propel the adoption of bookkeeping software. This finance tracking software enhances efficiency by monitoring all accounting transactions and managing the flow of money in and out of businesses. The market has witnessed a significant proportion of vendors with accounting at the core, capitalizing on the cost benefits of the cloud. They have been targeting the ever niche "micro and small and medium" businesses. Advanced features, such as artificial intelligence, are being incorporated into these budgeting software solutions for applications such as planning, learning, problem-solving, and speech recognition. For more detailed insights, a free PDF download of the full report is available. This report includes information on invoicing software, payroll software, tax preparation software, expense tracking software, and billing software.